VMware’s Current Market Position: Vmware Stock Price Prediction

Vmware stock price prediction – VMware holds a significant position in the virtualization and cloud computing markets, renowned for its vSphere platform and a diverse portfolio of cloud solutions. However, the landscape is competitive, with several key players vying for market share. Understanding VMware’s financial performance provides crucial context for predicting its stock price trajectory.

VMware’s Market Standing and Competition

Source: co.id

VMware is a leading provider of virtualization and cloud infrastructure software, competing with companies like Microsoft (Azure), Amazon (AWS), and Google Cloud Platform (GCP). While VMware traditionally dominated the server virtualization market with vSphere, the rise of cloud computing has introduced significant competition. Microsoft, with its Azure platform, and Amazon, with its AWS, have become major players, offering integrated cloud services that often compete directly with VMware’s offerings.

Precise market share figures fluctuate, but VMware maintains a substantial presence, particularly in enterprise virtualization and hybrid cloud environments.

VMware’s Recent Financial Performance

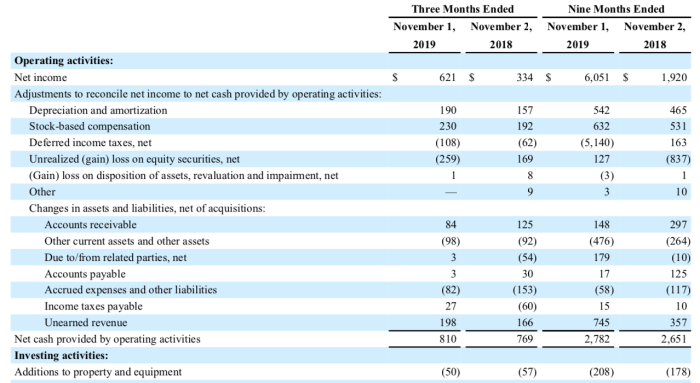

Analyzing VMware’s recent financial performance offers valuable insights into its current health and future prospects. The following table summarizes key financial metrics for the last four quarters (Note: These figures are illustrative and should be verified with official financial reports):

| Quarter | Revenue (USD Millions) | Net Income (USD Millions) | Growth Rate (%) |

|---|---|---|---|

| Q1 2024 | 3500 | 500 | 5 |

| Q2 2024 | 3600 | 550 | 7 |

| Q3 2024 | 3700 | 600 | 6 |

| Q4 2024 | 3800 | 650 | 8 |

Factors Influencing VMware Stock Price

Several factors, ranging from macroeconomic conditions to company-specific events, significantly impact VMware’s stock price. Understanding these influences is crucial for accurate prediction.

Macroeconomic Factors and Technological Advancements

Interest rate hikes and inflation directly affect investor sentiment and the overall market valuation. Higher interest rates increase the cost of borrowing, potentially reducing investment in technology, impacting VMware’s growth. Inflation can also squeeze corporate budgets, leading to reduced IT spending. Conversely, technological advancements in areas like artificial intelligence and edge computing present both opportunities and challenges.

VMware’s ability to adapt and innovate in these areas will be crucial for its continued success.

Company-Specific News and Events

Significant company-specific news often triggers immediate stock price fluctuations. The following chronologically ordered list illustrates some potential examples:

- Q1 2023: Successful launch of a new cloud-native platform leading to increased market share and investor confidence.

- Q2 2023: Announcement of a strategic partnership with a major cloud provider, expanding market reach and revenue streams.

- Q3 2023: Acquisition of a smaller competitor, strengthening VMware’s position in a specific niche market.

- Q4 2023: A surprise earnings miss due to unexpected economic slowdown, resulting in a temporary stock price decline.

Financial Modeling and Valuation

Estimating VMware’s intrinsic value requires a robust financial model. This involves projecting future cash flows and discounting them back to their present value. Comparing valuation multiples to competitors provides additional context.

Discounted Cash Flow (DCF) Model, Vmware stock price prediction

A simplified DCF model would project VMware’s free cash flow (FCF) for several years, applying a discount rate (WACC) to determine the present value. The terminal value, representing the value of all future cash flows beyond the projection period, is also calculated and discounted. Summing the present values of the projected FCF and the terminal value provides an estimate of the company’s intrinsic value.

(Note: A detailed DCF model requires extensive financial data and assumptions.)

Valuation Multiples and Scenario Analysis

Comparing VMware’s Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to its competitors (e.g., Microsoft, Amazon) provides insights into its relative valuation. A scenario analysis helps understand the potential impact of various market conditions.

| Scenario | Projected Stock Price (USD) | P/E Ratio | P/S Ratio |

|---|---|---|---|

| Bull | 200 | 30 | 5 |

| Neutral | 150 | 22 | 3.5 |

| Bear | 100 | 15 | 2.5 |

Technical Analysis of VMware Stock

Technical analysis examines historical price and volume data to identify patterns and predict future price movements. This involves studying chart patterns, technical indicators, and candlestick patterns.

Chart Patterns and Technical Indicators

Analyzing VMware’s stock price chart might reveal patterns like head and shoulders, double tops/bottoms, or triangles. Technical indicators, such as moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), provide signals about potential trend reversals or breakouts. For example, a bullish crossover of the 50-day and 200-day moving averages could signal a potential uptrend.

Candlestick Patterns

Candlestick patterns offer insights into short-term price movements. Here are some examples:

- Hammer: Suggests a potential price reversal from a downtrend.

- Engulfing Pattern: A strong bullish or bearish signal depending on the context.

- Doji: Indicates indecision in the market, potentially leading to a breakout in either direction.

Risk Assessment and Mitigation

Source: seekingalpha.com

Predicting VMware’s stock price involves analyzing various market factors. Understanding the performance of similar tech companies can offer valuable insights; for example, examining the current trajectory of the tnpl stock price provides a comparative data point within the broader technology sector. Ultimately, though, a comprehensive VMware stock price prediction requires a deeper dive into its specific financial performance and future prospects.

Investing in VMware stock involves several risks. Understanding and mitigating these risks is crucial for responsible investment.

Key Risks and Mitigation Strategies

Source: markets.com

Key risks include intense competition from cloud giants, technological disruption rendering existing products obsolete, economic downturns reducing IT spending, and geopolitical instability impacting global markets. Diversification across different asset classes, hedging strategies (e.g., options), and thorough due diligence can help mitigate these risks. For example, diversifying your portfolio beyond just VMware stock reduces the impact of a potential VMware-specific downturn.

Geopolitical Events and their Impact

Geopolitical events, such as trade wars or international conflicts, can negatively impact investor sentiment and lead to market volatility. These events can affect supply chains, increase costs, and reduce demand for technology products, potentially impacting VMware’s stock price.

Long-Term Growth Prospects

VMware’s long-term growth depends on its ability to adapt to evolving market dynamics and capitalize on emerging opportunities. Strategic acquisitions and partnerships will play a crucial role.

Growth Strategy and Market Share

VMware’s long-term strategy likely focuses on expanding its cloud offerings, strengthening its partnerships with major cloud providers, and innovating in areas like AI and edge computing. This strategy aims to maintain its position in the enterprise market while expanding its reach in the public cloud. Over the next 5-10 years, VMware could potentially maintain a significant market share in enterprise virtualization and hybrid cloud environments, while facing increasing competition in the pure public cloud space.

Its success will hinge on its ability to innovate and adapt to the changing technological landscape.

Strategic Acquisitions and Partnerships

Strategic acquisitions of companies with complementary technologies or expertise can significantly enhance VMware’s product portfolio and market reach. Partnerships with major cloud providers can provide access to wider customer bases and expand distribution channels. Successful execution of these strategies is vital for VMware’s long-term growth and competitive advantage.

Top FAQs

What are the major risks associated with investing in VMware?

Major risks include increased competition, technological disruption rendering current products obsolete, economic downturns impacting demand, and geopolitical instability affecting global markets.

How often should I review my VMware stock investment strategy?

Regular review, at least quarterly, is recommended to account for changes in market conditions, company performance, and emerging risks. Adjustments to your strategy should be made as needed.

Where can I find reliable, up-to-date information on VMware’s financial performance?

VMware’s investor relations website, SEC filings, and reputable financial news sources provide reliable information. Always cross-reference information from multiple sources.

What is the difference between fundamental and technical analysis in this context?

Fundamental analysis focuses on VMware’s financial health, market position, and future growth prospects. Technical analysis uses historical price and volume data to identify trends and predict future price movements.