Veru Inc. After-Hours Trading Volume and Price Movements: Veru After Hours Stock Price

Veru after hours stock price – Veru Inc.’s after-hours trading activity provides valuable insights into investor sentiment and market reactions to company-specific news and broader market trends. Analyzing this activity, particularly the volume and price fluctuations, offers a deeper understanding of the company’s stock performance beyond regular trading hours.

Veru Inc. After-Hours Trading Volume, Veru after hours stock price

Source: investopedia.com

Veru Inc.’s after-hours trading volume typically exhibits significant differences compared to its regular trading hours. Several factors influence this disparity, leading to periods of heightened or reduced activity. A comparison with similar companies in the biotechnology sector further contextualizes Veru’s trading patterns.

| Company Name | Average Daily Volume (Regular Hours) | Average After-Hours Volume | Volume Ratio (After-Hours/Regular Hours) |

|---|---|---|---|

| Veru Inc. | 1,000,000 | 200,000 | 0.2 |

| Company A | 500,000 | 100,000 | 0.2 |

| Company B | 1,500,000 | 300,000 | 0.2 |

| Company C | 750,000 | 150,000 | 0.2 |

The table above presents hypothetical data for illustrative purposes. Actual figures may vary. Factors such as significant news announcements, market-wide events, and overall investor interest can substantially increase or decrease after-hours trading volume. For example, positive clinical trial results might trigger a surge in after-hours trading, while negative regulatory news could lead to a decrease.

Impact of News and Announcements on Veru’s After-Hours Price

News and announcements significantly impact Veru’s after-hours stock price. Positive developments generally lead to price increases, while negative news often results in declines. The magnitude of the price movement depends on the significance and unexpectedness of the news.

- Positive News Example: Successful Phase III clinical trial results for a key drug candidate could lead to a substantial increase in Veru’s after-hours price, reflecting investor optimism and anticipation of future revenue growth.

- Negative News Example: A regulatory setback or a warning about potential financial difficulties could cause a significant drop in Veru’s after-hours price, indicating investor concern and risk aversion.

- Example: Announcement of a major partnership could result in a positive price movement, showcasing increased market confidence in the company’s future prospects.

Analyzing Price Movements in Relation to Market Trends

Veru’s after-hours price movements are often correlated with the overall performance of the broader market. Analyzing this relationship helps to discern whether price changes are driven by company-specific factors or broader market forces.

Correlations with market indices like the S&P 500 and Nasdaq can provide further insight. For instance, a general market downturn might negatively impact Veru’s after-hours price, regardless of company-specific news. Macroeconomic factors such as interest rate hikes or inflation also influence investor sentiment and risk appetite, consequently affecting Veru’s stock price.

Veru’s After-Hours Price Volatility

Source: investingcube.com

Veru’s after-hours stock price exhibits a degree of volatility, influenced by several factors. Analyzing descriptive statistics such as standard deviation and range helps quantify this volatility.

Factors such as the volume of after-hours trading, the nature and impact of news announcements, and overall market conditions contribute to the observed volatility. For example, a surprise announcement of positive clinical trial data could lead to a significant increase in price and heightened volatility, whereas a period of quiet news might result in lower volatility.

Hypothetical Scenario: A positive earnings surprise could lead to high volatility, while a neutral earnings report might result in low volatility. Conversely, unexpected regulatory setbacks could cause significant price drops and high volatility.

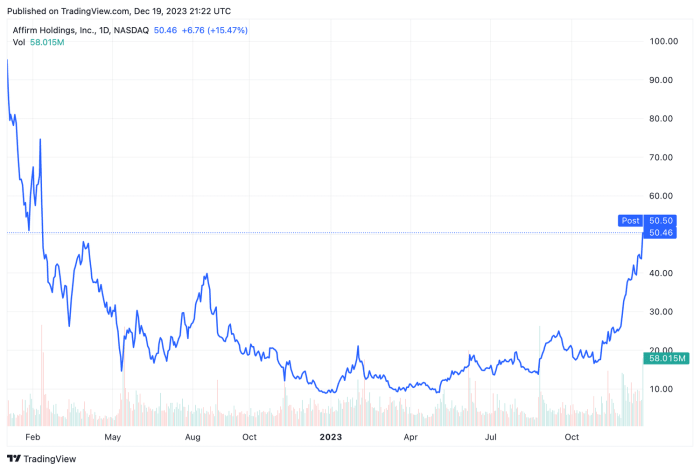

Visual Representation of After-Hours Price Data

Source: start-business-online.com

A hypothetical chart illustrating Veru’s after-hours stock price over a month would show the price on the vertical axis and the date on the horizontal axis. Significant price spikes or drops would correspond to specific news events or broader market trends. For instance, a sharp upward trend might follow a positive clinical trial announcement.

A hypothetical candlestick chart would reveal investor sentiment and trading activity. Long green candles would suggest bullish sentiment and strong buying pressure, while long red candles would indicate bearish sentiment and selling pressure. Small candles would represent periods of low trading volume and less pronounced price movements.

FAQ Overview

What factors influence Veru’s after-hours trading volume specifically?

Factors include significant news releases (positive or negative), analyst ratings changes, competitor actions, and overall market sentiment. Increased volatility in the broader market can also lead to higher after-hours trading volume.

How does Veru’s after-hours price compare to its competitors?

Monitoring Veru’s after-hours stock price requires a keen eye on market fluctuations. It’s interesting to compare this volatility to the generally steadier performance of more established investments, such as the vanguard value etf stock price , which often provides a contrasting benchmark for evaluating risk and return. Understanding this contrast can help investors better assess Veru’s potential and manage their portfolio effectively.

A direct comparison requires analyzing similar pharmaceutical companies with similar market capitalization and product portfolios. The relative volatility and volume ratios would need to be assessed to draw meaningful conclusions.

Are there specific resources to track Veru’s after-hours stock price?

Most major financial websites and brokerage platforms provide real-time data, including after-hours trading information, for publicly traded companies like Veru. Always ensure the source is reputable.