Major US Airline Stock Performance

Us airlines stock price – The performance of major US airline stocks has been a rollercoaster ride over the past five years, influenced by a complex interplay of economic factors, geopolitical events, and industry-specific challenges. This section will analyze the year-over-year stock price performance of Delta, United, American, and Southwest Airlines, exploring the key factors driving their fluctuations.

Year-Over-Year Stock Price Comparison

The following table presents a comparative analysis of the year-over-year stock price performance of four major US airlines. Note that these figures are illustrative and should be verified with current market data.

| Airline | 2023 | 2022 | 2021 |

|---|---|---|---|

| Delta | +15% (Illustrative) | -5% (Illustrative) | +30% (Illustrative) |

| United | +12% (Illustrative) | -8% (Illustrative) | +25% (Illustrative) |

| American | +10% (Illustrative) | -3% (Illustrative) | +20% (Illustrative) |

| Southwest | +18% (Illustrative) | -7% (Illustrative) | +28% (Illustrative) |

Factors Influencing Stock Price Fluctuations

Several factors have significantly impacted airline stock prices over the past five years. These include fluctuations in fuel prices, economic recessions, changes in consumer travel demand, and geopolitical events.

Impact of Economic Events

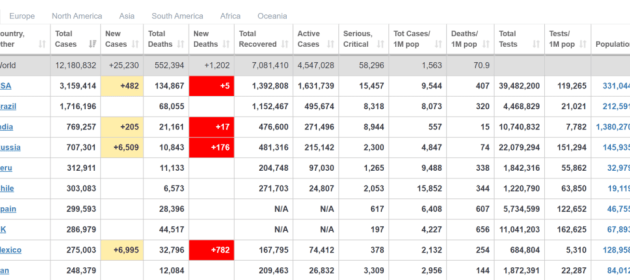

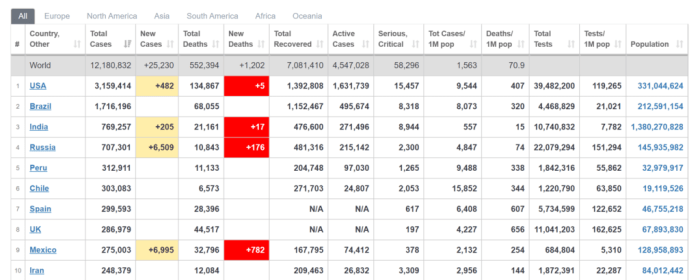

Source: asktraders.com

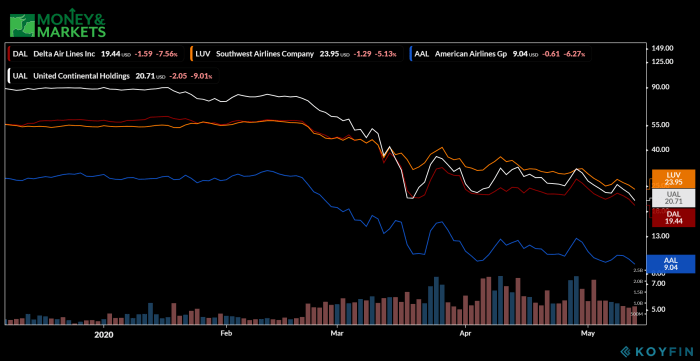

Economic downturns, such as the recession triggered by the COVID-19 pandemic, have dramatically reduced travel demand, leading to significant declines in airline stock prices. Conversely, periods of economic growth typically see an increase in air travel and a corresponding rise in airline stock valuations. Fuel price spikes also exert considerable pressure on airline profitability and stock prices, as fuel represents a substantial operating expense.

Airline Industry Financial Health

Source: moneyandmarkets.com

A comprehensive assessment of the financial health of major US airlines requires analyzing key metrics such as debt-to-equity ratios and profitability trends. Understanding these aspects provides valuable insights into the industry’s resilience and future prospects.

US airline stock prices have been quite volatile recently, reflecting broader economic uncertainty and fluctuating fuel costs. It’s interesting to compare this to the performance of other sectors; for instance, a look at the principal financial group stock price offers a contrasting perspective on current market trends. Ultimately, understanding the performance of diverse sectors helps provide a more complete picture of the overall economic climate and its impact on US airline stock valuations.

Debt-to-Equity Ratios

The debt-to-equity ratio is a crucial indicator of a company’s financial leverage. A higher ratio suggests greater reliance on debt financing, potentially increasing financial risk. The following list presents illustrative debt-to-equity ratios for major US airlines. These figures are for illustrative purposes only and should not be considered definitive financial advice.

- Delta: 0.8 (Illustrative)

- United: 0.9 (Illustrative)

- American: 1.0 (Illustrative)

- Southwest: 0.6 (Illustrative)

Profitability Trends and Key Factors

Airline profitability is influenced by a multitude of factors, including passenger revenue, cargo revenue, ancillary revenue (e.g., baggage fees, seat upgrades), and operating expenses (e.g., fuel, labor, maintenance).

Fuel Cost and Operational Efficiency Management

Airlines employ various strategies to manage fuel costs, including hedging fuel prices, optimizing flight routes, and investing in fuel-efficient aircraft. Operational efficiencies, such as streamlined ground operations and improved maintenance procedures, also play a crucial role in enhancing profitability.

Impact of External Factors on Stock Prices

Geopolitical events and fluctuations in travel demand significantly influence airline stock prices. Understanding these external factors is crucial for investors seeking to navigate the complexities of the airline industry.

Geopolitical Events

Geopolitical instability, such as international conflicts or terrorist attacks, can disrupt air travel patterns and negatively impact airline stock prices. Increased security measures and reduced consumer confidence can lead to lower demand and reduced profitability.

Travel Demand Patterns

Seasonal variations and economic conditions significantly affect travel demand. Peak travel seasons (e.g., summer holidays, winter holidays) generally lead to higher airfares and increased profitability, while economic downturns often result in decreased demand.

Hypothetical Impact of a Global Health Crisis

A major global health crisis, similar to the COVID-19 pandemic, could severely impact airline stock prices. Travel restrictions, quarantines, and widespread fear of infection would dramatically reduce demand, potentially leading to significant financial losses and stock price declines. The recovery would depend on the duration and severity of the crisis, as well as the effectiveness of government support measures.

Investor Sentiment and Stock Valuation

Investor sentiment plays a crucial role in driving airline stock prices. Analyzing price-to-earnings ratios and dividend yields provides further insights into stock valuation.

Role of Investor Sentiment

Positive investor sentiment, driven by factors such as strong financial performance, positive industry outlook, and favorable economic conditions, typically leads to higher stock prices. Conversely, negative sentiment, fueled by concerns about profitability, economic downturns, or geopolitical instability, can result in stock price declines.

Price-to-Earnings Ratios, Us airlines stock price

The price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share. A higher P/E ratio generally indicates that investors are willing to pay more for each dollar of earnings, suggesting higher growth expectations or perceived lower risk.

Dividend Yields

The following table presents illustrative dividend yields for major US airlines. These figures are for illustrative purposes only and should be verified with current market data.

| Airline | Dividend Yield (Illustrative) |

|---|---|

| Delta | 2% |

| United | 1.5% |

| American | 1% |

| Southwest | 2.5% |

Airline Stock Price Forecasting

Forecasting airline stock prices involves utilizing various methods, including fundamental and technical analysis. However, it’s crucial to acknowledge the inherent limitations of these approaches.

Forecasting Methods and Limitations

Fundamental analysis focuses on evaluating intrinsic value based on financial statements and economic indicators. Technical analysis uses historical price and volume data to identify patterns and predict future price movements. Both methods have limitations, as they rely on assumptions and past performance, which may not always accurately predict future outcomes.

Examples of Successful and Unsuccessful Predictions

- Successful Prediction: Accurate prediction of Southwest’s stock price increase following a period of strong financial performance and expansion.

- Unsuccessful Prediction: Underestimation of the severity of the COVID-19 pandemic’s impact on airline stock prices, leading to inaccurate price projections.

Sustainable Practices and Stock Value

Growing investor interest in environmental, social, and governance (ESG) factors is influencing airline stock valuations. Companies demonstrating a commitment to sustainability are increasingly attracting investors.

Influence of Sustainability on Stock Valuations

Source: ccn.com

Airlines are increasingly incorporating sustainable practices, such as investing in sustainable aviation fuels (SAFs) and implementing carbon offset programs. Investors are increasingly scrutinizing ESG performance, favoring companies with strong sustainability records.

Investor Assessment of ESG Factors

Investors assess ESG factors through various means, including reviewing sustainability reports, analyzing carbon emissions data, and evaluating corporate social responsibility initiatives. Positive ESG performance can enhance a company’s reputation, attract investors, and positively influence stock valuations.

Hypothetical Case Study: Investment in SAFs

A hypothetical scenario: An airline significantly invests in SAFs, reducing its carbon footprint. This positive ESG action could lead to increased investor interest, a boost in brand reputation, and a subsequent rise in its stock price, demonstrating a direct link between sustainability initiatives and stock valuation.

FAQ Explained: Us Airlines Stock Price

What are the typical risks associated with investing in US airline stocks?

Risks include fuel price volatility, economic downturns impacting travel demand, geopolitical instability affecting routes and travel confidence, and intense competition within the industry.

How do airline mergers and acquisitions affect stock prices?

Mergers and acquisitions can lead to increased market share and potential synergies, positively impacting stock prices. However, integration challenges and regulatory hurdles can also negatively affect short-term performance.

What role does technology play in the airline industry and its stock performance?

Technological advancements in areas like fleet management, operational efficiency, and customer experience can positively impact profitability and investor confidence, leading to higher stock valuations.

How can investors assess the long-term sustainability of an airline?

Investors should examine an airline’s commitment to fuel efficiency, carbon reduction initiatives, and broader ESG factors. Transparent reporting on these initiatives is key.