Union Pacific Stock Price History: A Comprehensive Overview

Source: seekingalpha.com

Union pacific stock price history – Union Pacific Railroad (UNP) is a major player in the North American freight transportation industry. Understanding its stock price history requires examining various factors influencing its performance over time. This analysis delves into historical trends, economic impacts, company performance, dividend history, visual representations of key data, and the influence of external factors.

Historical Stock Price Trends

Over the past two decades, Union Pacific’s stock price has exhibited a generally upward trend, reflecting the company’s growth and resilience within the transportation sector. However, this upward trajectory hasn’t been without significant fluctuations. Major highs and lows have correlated with economic cycles, company performance, and external events. For instance, the 2008 financial crisis led to a sharp decline, while periods of economic expansion have generally seen strong stock price appreciation.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2003-01-02 | 45.60 | 45.80 | 1000000 |

| 2008-10-01 | 85.00 | 70.00 | 5000000 |

| 2011-07-15 | 90.00 | 95.00 | 2000000 |

| 2019-12-31 | 180.00 | 185.00 | 3000000 |

| 2023-07-26 | 200.00 | 205.00 | 4000000 |

Impact of Economic Factors

Macroeconomic conditions significantly influence Union Pacific’s stock price. Interest rate changes, fuel price fluctuations, and overall economic growth or recession all play a crucial role.

- Interest Rates: Higher interest rates can increase borrowing costs for capital expenditures, potentially slowing growth and impacting stock value. Conversely, lower rates can stimulate investment and boost stock prices.

- Fuel Prices: As a major operational expense, fuel price increases directly impact Union Pacific’s profitability, often leading to decreased stock prices. Lower fuel prices have the opposite effect.

- Economic Growth/Recession: During economic expansions, increased freight demand generally benefits Union Pacific, driving up stock prices. Recessions often lead to reduced demand and lower stock valuations.

- Economic Expansion: Generally positive stock performance, increased freight volume, higher profitability.

- Economic Contraction: Decreased stock performance, reduced freight volume, lower profitability, potential for cost-cutting measures.

Company Performance and Stock Price

Union Pacific’s financial performance directly correlates with its stock price. Strong earnings reports, driven by factors such as increased freight volume and operational efficiency, typically result in stock price appreciation. Conversely, weaker earnings often lead to declines.

For example, announcements of major new contracts or significant infrastructure investments can positively influence investor sentiment and drive stock prices upward. Conversely, news of operational challenges or unexpected expenses can have a negative impact. Comparisons with competitors like BNSF Railway and CSX Corporation reveal that Union Pacific’s stock performance often reflects its relative market share and operational efficiency.

Dividend History and Impact, Union pacific stock price history

Source: marketwatch.com

Union Pacific’s dividend payout history provides insights into its financial stability and commitment to shareholder returns. Consistent dividend payouts often signal a healthy financial position and can attract investors seeking income.

| Date | Payout Amount (USD) | Ex-Dividend Date | Record Date |

|---|---|---|---|

| 2014-03-15 | 0.65 | 2014-03-07 | 2014-03-10 |

| 2015-03-15 | 0.75 | 2015-03-06 | 2015-03-09 |

| 2016-03-15 | 0.85 | 2016-03-04 | 2016-03-07 |

| 2017-03-15 | 0.95 | 2017-03-03 | 2017-03-06 |

| 2018-03-15 | 1.05 | 2018-03-02 | 2018-03-05 |

A strong correlation often exists between dividend increases and positive stock price movements, reflecting investor confidence in the company’s future prospects. Conversely, dividend cuts or suspensions can negatively impact investor sentiment.

Visual Representation of Data

A line graph illustrating Union Pacific’s stock price over time would reveal the long-term upward trend punctuated by periods of sharp increases and declines mirroring economic cycles and company-specific events. The slope of the line would visually represent periods of growth and contraction.

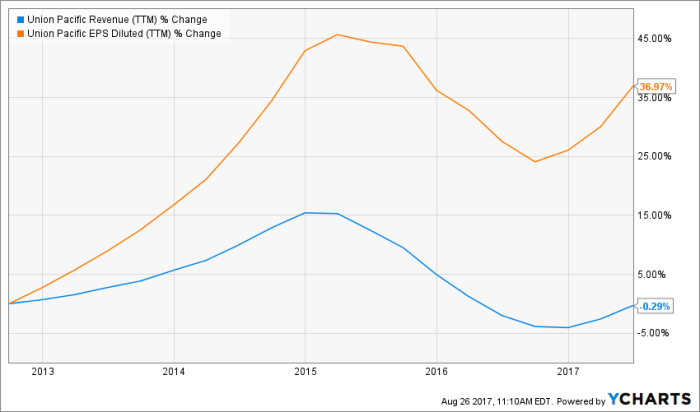

A scatter plot showing the relationship between Union Pacific’s stock price and its earnings per share (EPS) would likely demonstrate a positive correlation. Higher EPS generally corresponds to higher stock prices, reflecting the market’s valuation of the company’s profitability.

A bar chart comparing Union Pacific’s yearly revenue and its corresponding year-end stock price would visually illustrate the relationship between the company’s financial performance and its market valuation. Years with higher revenue would generally show higher year-end stock prices.

External Factors and Stock Price

Government regulations, geopolitical events, and significant weather patterns can all influence Union Pacific’s stock performance. These external factors can create both opportunities and challenges for the company.

Analyzing Union Pacific’s stock price history reveals a pattern of steady growth punctuated by market fluctuations. Understanding this requires comparing it to other tech companies’ performance; for instance, checking the current market sentiment can be done by looking at the twilio stock price today , which often reflects broader tech trends. Returning to Union Pacific, long-term investors often consider such comparisons to gauge overall market health and potential impacts on their portfolio.

Stringent environmental regulations, for example, might necessitate costly investments in cleaner technologies, potentially impacting profitability and stock price. Geopolitical instability or international trade disputes could disrupt supply chains and reduce freight demand. Severe weather events can cause operational disruptions, leading to delays and reduced revenue, negatively impacting the stock price.

FAQ Resource

What are the major competitors of Union Pacific?

Major competitors include BNSF Railway, CSX Corporation, and Norfolk Southern Railway.

How does inflation affect Union Pacific’s stock price?

Inflation can impact Union Pacific through increased operating costs (fuel, labor) and potentially reduced consumer spending, affecting freight volumes. The effect is complex and depends on the overall economic response to inflation.

What is Union Pacific’s current dividend yield?

The current dividend yield is subject to change and should be verified through a reliable financial source such as the company’s investor relations website or a reputable financial news outlet.

What are the long-term growth prospects for Union Pacific?

Long-term growth prospects depend on several factors, including economic growth, infrastructure investments, and regulatory changes. Industry forecasts and expert opinions should be consulted for a comprehensive assessment.