Ultragenyx Stock Price Analysis

Ultragenyx stock price – Ultragenyx Pharmaceutical Inc. (ULRX) operates in the competitive biotechnology sector, focusing on the development and commercialization of novel therapies for rare and ultra-rare diseases. Understanding its stock price performance requires examining various factors, from its financial health and clinical trial outcomes to broader economic conditions and market sentiment.

Ultragenyx Stock Price Historical Performance

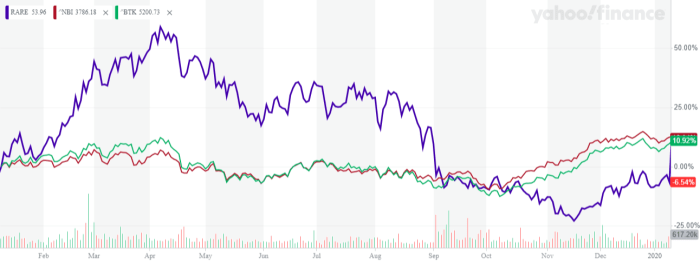

A line graph illustrating Ultragenyx’s stock price fluctuations over the past five years would reveal periods of both significant growth and decline. The graph would clearly show the highest and lowest points reached during this period, highlighting key dates of substantial price movements. For instance, a surge in price might correlate with a positive clinical trial result, while a dip could reflect a period of market uncertainty or negative news concerning a specific drug candidate.

Over the past five years, Ultragenyx’s stock price reached a high of [Insert Highest Price] on [Insert Date] and a low of [Insert Lowest Price] on [Insert Date]. These fluctuations reflect the inherent volatility within the biotechnology sector, where investor sentiment is heavily influenced by clinical trial data and regulatory approvals.

Comparing Ultragenyx’s performance to its main competitors over the past year requires considering factors like revenue growth, pipeline progress, and market capitalization. A table comparing year-to-date and five-year performance against competitors such as [Competitor 1], [Competitor 2], and [Competitor 3] would provide a clear overview. For example, a competitor might have outperformed Ultragenyx due to a successful drug launch or a positive regulatory decision.

Conversely, Ultragenyx might have seen better performance based on its own unique pipeline or market positioning.

| Company | Year-to-Date Performance | 5-Year Performance |

|---|---|---|

| Ultragenyx | [Insert Percentage Change] | [Insert Percentage Change] |

| Competitor 1 | [Insert Percentage Change] | [Insert Percentage Change] |

| Competitor 2 | [Insert Percentage Change] | [Insert Percentage Change] |

| Competitor 3 | [Insert Percentage Change] | [Insert Percentage Change] |

Factors Influencing Ultragenyx Stock Price

Source: seekingalpha.com

Several economic and company-specific factors significantly impact Ultragenyx’s stock price. These factors interact in complex ways, making accurate prediction challenging but essential for informed investment decisions.

Three major economic factors impacting Ultragenyx’s stock price in the last two years include overall market volatility, interest rate changes, and investor sentiment towards the biotechnology sector as a whole. For example, periods of high market volatility often lead to increased uncertainty, affecting even fundamentally strong companies like Ultragenyx. Similarly, rising interest rates can negatively impact the valuation of growth-oriented biotech companies, as they increase the discount rate applied to future cash flows.

Clinical trial results have a profound impact on Ultragenyx’s stock price. Positive results from pivotal trials for its drug candidates typically lead to significant price increases, while negative results or setbacks can trigger substantial drops. For example, the successful completion of Phase 3 trials for [Drug Name] could lead to a substantial stock price increase, reflecting investor confidence in the drug’s potential for market success.

Conversely, failure to meet primary endpoints in a clinical trial would likely result in a significant price decrease.

News releases and announcements from Ultragenyx regarding partnerships, regulatory approvals, or financial results also directly influence its stock price. A strategic partnership with a larger pharmaceutical company, for example, could boost investor confidence and drive up the stock price. Similarly, receiving regulatory approval for a new drug would be a major catalyst for price appreciation. Conversely, disappointing financial results or delays in regulatory approvals would likely have a negative impact.

Ultragenyx’s Financial Performance and Stock Valuation

Analyzing Ultragenyx’s key financial metrics provides insights into its financial health and growth prospects. This data, when compared to industry averages, helps determine whether the company is undervalued or overvalued by the market.

| Year | Revenue (USD Millions) | Earnings per Share (USD) |

|---|---|---|

| 2021 | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] |

Comparing Ultragenyx’s Price-to-Earnings (P/E) ratio to its industry average helps assess its relative valuation. A higher P/E ratio than the industry average might suggest that the market expects higher future growth from Ultragenyx, while a lower P/E ratio could indicate that the market views the company as relatively undervalued. However, it’s crucial to consider other valuation metrics alongside P/E ratio to obtain a comprehensive view.

In a hypothetical scenario where Ultragenyx announces a significant new drug approval, the stock price would likely experience a substantial surge. This is because a new drug approval validates the company’s research and development efforts, opens new revenue streams, and increases the company’s overall market value. The magnitude of the price increase would depend on factors such as the drug’s market potential, the size of the target market, and the overall competitive landscape.

Analyst Ratings and Predictions for Ultragenyx Stock

Source: seekingalpha.com

Analyst ratings and price targets provide valuable insights into the market’s expectations for Ultragenyx’s future performance. However, it is important to remember that these are just predictions and should be considered alongside other information.

Ultragenyx’s stock price performance often reflects broader market trends. For instance, understanding the overall market sentiment can be helpful; checking the tesla closing stock price today provides a useful benchmark for the tech sector’s health, which can indirectly influence Ultragenyx’s valuation. Ultimately, however, Ultragenyx’s own news and financial performance are the primary drivers of its stock price fluctuations.

- Analyst A: [Rating], Price Target: [Price]

- Analyst B: [Rating], Price Target: [Price]

- Analyst C: [Rating], Price Target: [Price]

Disagreements among analysts often stem from differences in assumptions regarding the success of Ultragenyx’s clinical trials, the speed of regulatory approvals, and the overall market dynamics. For instance, some analysts might be more optimistic about the success of a particular drug candidate, leading to a higher price target, while others might be more cautious, resulting in a lower target.

Several risks and uncertainties could impact future stock price predictions. These include potential delays in clinical trials, unexpected safety concerns related to drug candidates, increased competition from other biotech companies, and fluctuations in overall market sentiment. For example, a competitor launching a similar drug could negatively impact Ultragenyx’s market share and consequently its stock price.

Investor Sentiment and Trading Volume

Understanding investor sentiment and trading volume provides valuable insights into the market’s current perception of Ultragenyx and the level of activity surrounding its stock.

Currently, investor sentiment towards Ultragenyx appears to be [Bullish/Bearish/Neutral]. This assessment is based on recent analyst ratings, news coverage, and the stock’s price performance. For example, a consistently rising stock price, coupled with positive analyst upgrades, would suggest a bullish sentiment. Conversely, a prolonged period of price decline and negative news coverage would indicate a bearish sentiment.

Analyzing Ultragenyx’s trading volume over the past year reveals periods of both high and low activity. High trading volume often occurs following major news announcements, such as clinical trial results or regulatory approvals, indicating increased investor interest and activity. Conversely, low trading volume may suggest a lack of significant news or investor apathy.

A chart illustrating daily or weekly trading volume over the past year would visually represent these periods of high and low activity. The chart would show spikes in volume corresponding to significant news events and periods of relatively low volume during periods of less market activity.

Essential FAQs

What are the major risks associated with investing in Ultragenyx?

Investing in Ultragenyx, like any biotech company, carries significant risk. These include the failure of clinical trials, regulatory setbacks, intense competition, and the inherent volatility of the biotechnology market. Market conditions and general economic factors also play a significant role.

How often does Ultragenyx release financial reports?

Ultragenyx typically releases quarterly and annual financial reports, following standard reporting practices for publicly traded companies. These reports provide details on revenue, earnings, and other key financial metrics.

Where can I find real-time Ultragenyx stock price data?

Real-time Ultragenyx stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is the typical trading volume for Ultragenyx stock?

Ultragenyx’s trading volume varies depending on market conditions and news events. Reviewing historical trading data on financial websites can provide insights into typical daily and weekly trading activity.