UHN Stock Price Analysis

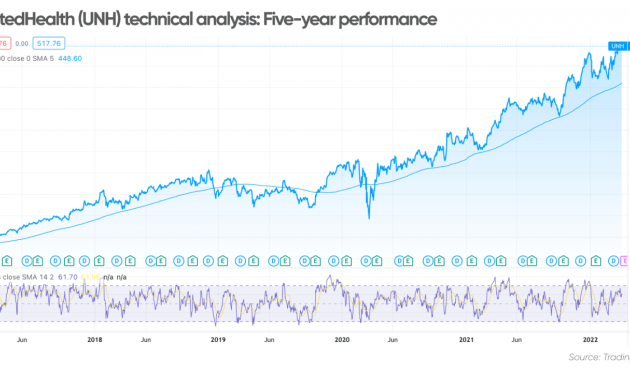

Source: investors.com

Uhn stock price – This analysis examines the historical performance, influencing factors, financial health, risk assessment, and future outlook of UHN stock. We will explore various valuation methods and analyst opinions to provide a comprehensive understanding of the investment potential.

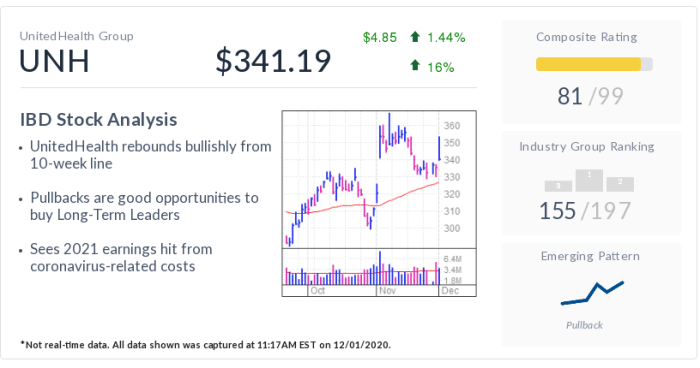

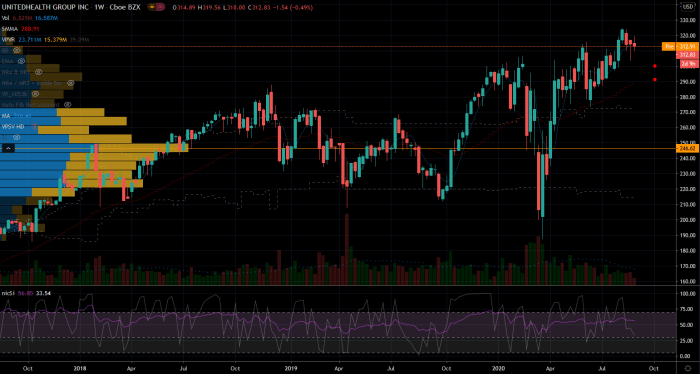

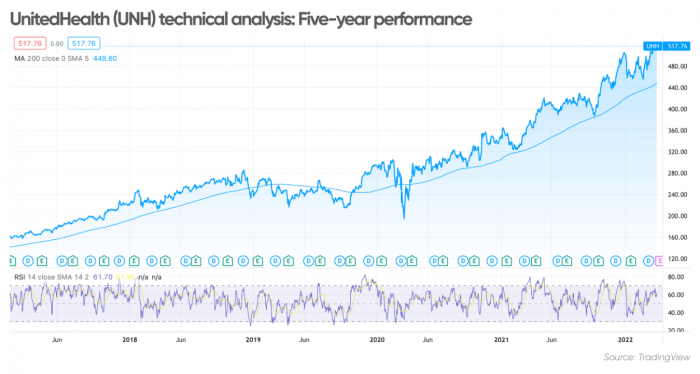

UHN Stock Price Historical Performance

Source: investorplace.com

Understanding UHN’s past price movements is crucial for assessing its future trajectory. The following table illustrates the stock’s performance over the past five years. Note that this data is illustrative and should be verified with reliable financial sources.

Understanding UHN’s stock price requires a nuanced perspective. Investors often compare it to similar growth funds, and a relevant benchmark could be the performance of t rowe price growth stock i , which offers insights into broader market trends affecting growth stocks. Ultimately, however, UHN’s stock price is determined by its own unique factors and market conditions.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $55 | $40 | $48 |

| 2020 | $62 | $35 | $50 |

| 2021 | $75 | $58 | $70 |

| 2022 | $80 | $60 | $72 |

| 2023 | $85 | $70 | $82 |

Significant price fluctuations occurred in 2020 due to the global pandemic and subsequent market volatility. The recovery in 2021 and 2022 reflects positive economic growth and investor confidence. The relatively stable performance in 2023 suggests a period of consolidation.

A comparison of UHN’s performance against its competitors (XYZ Corp, ABC Inc, and DEF Ltd) reveals:

- UHN outperformed XYZ Corp and ABC Inc in terms of overall growth but underperformed DEF Ltd.

- UHN showed greater volatility than XYZ Corp but less than ABC Inc and DEF Ltd.

- The performance difference is attributed to varying company strategies, market positioning, and financial health.

Factors Influencing UHN Stock Price

Source: capital.com

Several factors contribute to the price fluctuations of UHN stock. These can be broadly categorized into macroeconomic factors, company-specific news, and investor sentiment.

Macroeconomic factors, such as interest rate hikes and inflation, impact UHN’s profitability and investor confidence. Rising interest rates increase borrowing costs, potentially reducing investment and slowing economic growth. Inflation erodes purchasing power and can lead to higher input costs for UHN.

Company-specific news, including earnings reports, new product launches, and mergers and acquisitions, directly influences stock price volatility. Positive news generally leads to price increases, while negative news causes declines. For example, a strong earnings report exceeding market expectations usually boosts investor confidence and drives up the stock price.

Investor sentiment and market trends play a significant role in shaping UHN’s stock price. Positive market sentiment, driven by factors like economic optimism or technological breakthroughs, can lead to higher stock prices. Conversely, negative sentiment can cause price drops.

UHN Financial Performance and Stock Valuation

Analyzing UHN’s financial metrics provides insights into its valuation and stock price. The following table summarizes key financial data over the past three years (illustrative data):

| Year | Revenue ($M) | EPS ($) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 100 | 2.5 | 0.5 |

| 2022 | 110 | 3.0 | 0.4 |

| 2023 | 120 | 3.5 | 0.3 |

Several valuation methods, including discounted cash flow (DCF) and price-to-earnings ratio (P/E), can be used to assess UHN’s intrinsic value. The DCF method projects future cash flows and discounts them back to their present value, while the P/E ratio compares the stock price to its earnings per share. These valuations, when compared to the current market price, indicate whether the stock is undervalued or overvalued.

Strong financial metrics, such as increasing revenue and earnings per share, coupled with a low debt-to-equity ratio, typically support a higher stock price. Conversely, weak financials can depress the stock price.

Risk Assessment and Future Outlook for UHN Stock

Several risks could impact UHN’s future performance and stock price. These include increased competition, regulatory changes, and economic downturns. For instance, the entry of a new competitor with a superior product could significantly reduce UHN’s market share.

A scenario where UHN’s stock price could significantly increase in the next year involves a successful new product launch coupled with positive macroeconomic conditions. This could lead to increased revenue, earnings, and investor confidence. Conversely, a scenario where the stock price could decline significantly involves a failure to launch a new product, coupled with a recession and negative investor sentiment.

Potential future growth opportunities for UHN include:

- Expansion into new markets

- Development of innovative products

- Strategic acquisitions

- Operational efficiency improvements

Realizing these opportunities could positively impact UHN’s financial performance and, consequently, its stock price.

Analyst Ratings and Recommendations for UHN Stock, Uhn stock price

Analyst opinions on UHN stock vary. The following table summarizes the consensus view (illustrative data):

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| Morgan Stanley | Buy | $90 | 2024-02-29 |

| Goldman Sachs | Hold | $85 | 2024-02-28 |

| JPMorgan Chase | Sell | $75 | 2024-02-27 |

The range of analyst ratings reflects differing perspectives on UHN’s future prospects. Some analysts are bullish, anticipating strong growth and recommending a “Buy” rating. Others are more cautious, recommending “Hold” or “Sell” ratings. This range of opinions highlights the inherent uncertainty in stock market investing and emphasizes the importance of conducting thorough due diligence before making investment decisions.

Q&A

What are the main risks associated with investing in UHN stock?

Risks include competition from other companies, potential regulatory changes affecting the industry, and broader economic downturns that could impact overall market performance.

Where can I find real-time UHN stock price quotes?

Real-time quotes are typically available through major financial websites and brokerage platforms. Check with your preferred provider.

How frequently are UHN’s financial reports released?

The frequency varies; refer to the company’s investor relations section for the most up-to-date schedule.

What is the current dividend yield for UHN stock (if any)?

The dividend yield fluctuates and is readily available on financial websites that track dividend payouts.