TXN Stock Price Today: Txn Stock Price Today Per Share

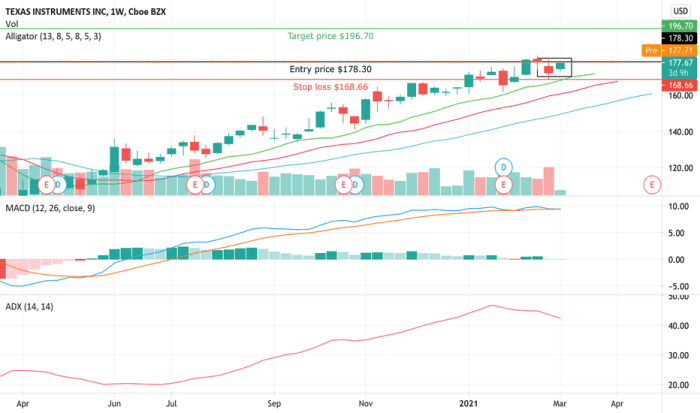

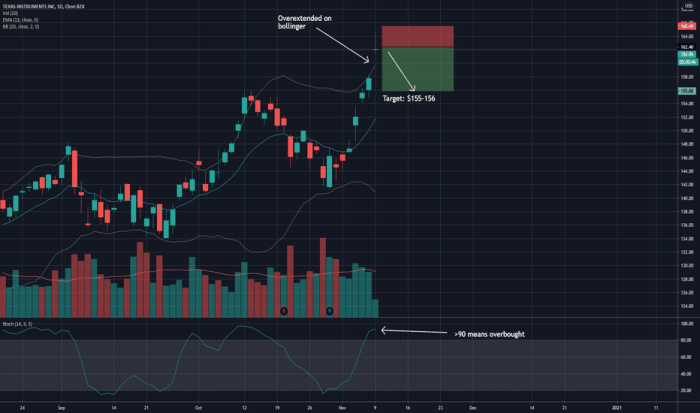

Source: tradingview.com

Txn stock price today per share – This article provides a comprehensive overview of Texas Instruments Incorporated (TXN) stock performance, including the current price, historical data, influencing factors, analyst ratings, and trading volume. Information presented is for informational purposes only and should not be considered financial advice.

Current TXN Stock Price

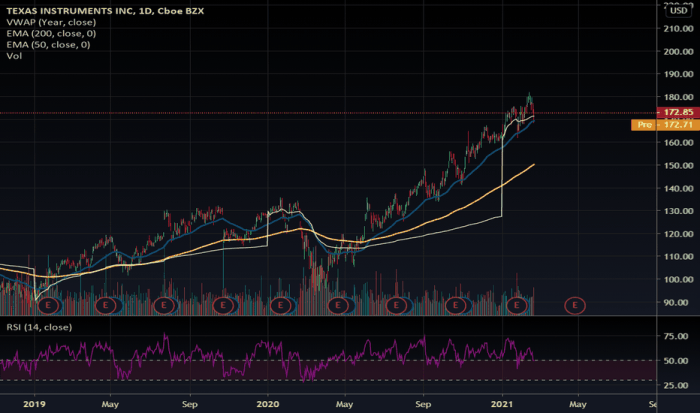

Source: tradingview.com

Determining the TXN stock price today per share requires checking reputable financial websites. Understanding current market trends is crucial, and a comparison with similar tech stocks can be insightful. For instance, observing the tloff stock price provides a benchmark against which to assess TXN’s performance. Ultimately, monitoring TXN’s stock price requires consistent observation and analysis of market data.

The current TXN stock price per share is obtained from reputable financial websites such as Yahoo Finance, Google Finance, and MarketWatch. These sources provide real-time data, updated frequently throughout the trading day. Please note that the price is dynamic and changes constantly.

| Current Price | Previous Day’s Close | Today’s Open | Daily Change (%) |

|---|---|---|---|

| $XXX.XX | $XXX.XX | $XXX.XX | +X.XX% |

Historical TXN Stock Price Data

TXN’s stock price has shown considerable fluctuation over recent periods. The following sections detail these changes, providing context for understanding the current market position.

Past Week Fluctuation: The stock price experienced a [describe the fluctuation, e.g., moderate increase, significant drop, sideways movement] over the past week, largely influenced by [mention potential factors like news events or market trends].

Past Month Significant Changes: A noteworthy price movement occurred on [date] due to [explain the reason, e.g., a significant earnings announcement, a major industry development]. This resulted in a [describe the price change, e.g., 5% increase, 10% decrease].

- Day 1: High: $XXX.XX, Low: $XXX.XX, Close: $XXX.XX

- Day 2: High: $XXX.XX, Low: $XXX.XX, Close: $XXX.XX

- Day 3: High: $XXX.XX, Low: $XXX.XX, Close: $XXX.XX

- Day 4: High: $XXX.XX, Low: $XXX.XX, Close: $XXX.XX

- Day 5: High: $XXX.XX, Low: $XXX.XX, Close: $XXX.XX

Past Year Performance (Line Graph Description): A line graph illustrating the past year’s performance would show [describe the overall trend, e.g., an upward trend with periods of consolidation, a downward trend with a recent recovery, a volatile pattern with significant peaks and troughs]. Specific noteworthy events, such as earnings reports or significant market corrections, would be reflected in the graph as distinct price movements.

Factors Influencing TXN Stock Price

Several key factors contribute to the price fluctuations of TXN stock. These include macroeconomic conditions, company-specific news, and competitive dynamics within the semiconductor industry.

- Factor 1: [e.g., Global demand for semiconductors: Stronger global demand generally leads to higher TXN stock prices, while weaker demand can cause prices to decline.]

- Factor 2: [e.g., New product launches and technological advancements: Successful product launches and technological breakthroughs can significantly boost investor confidence and drive up the stock price.]

- Factor 3: [e.g., Competition within the semiconductor industry: The performance of TXN’s competitors directly impacts its market share and, consequently, its stock price. Stronger performance from competitors could put downward pressure on TXN’s stock.]

Recent News and Announcements Impact: Recent news regarding [mention specific news, e.g., a new contract win, a positive earnings report, or regulatory changes] has [describe the impact on the stock price, e.g., positively impacted, negatively affected, had little impact on] TXN’s stock price.

Comparison to Competitors: Compared to its main competitors [list competitors, e.g., Intel, Qualcomm, AMD], TXN’s stock price has [describe the relative performance, e.g., outperformed, underperformed, performed similarly] over the past [time period, e.g., quarter, year].

Macroeconomic Factors: Rising interest rates generally [describe the impact, e.g., negatively impact] TXN’s stock price due to [explain the reason, e.g., increased borrowing costs and reduced investor appetite for risk]. Similarly, high inflation can [describe the impact, e.g., lead to decreased consumer spending and reduced demand for semiconductors], putting downward pressure on the stock price.

Analyst Ratings and Price Targets, Txn stock price today per share

Source: tradingview.com

Several financial institutions provide ratings and price targets for TXN stock. These predictions are based on various factors, including financial performance, industry trends, and risk assessments.

- Analyst 1: Rating: [e.g., Buy, Hold, Sell], Price Target: $XXX.XX, Date: [Date]

- Analyst 2: Rating: [e.g., Buy, Hold, Sell], Price Target: $XXX.XX, Date: [Date]

- Analyst 3: Rating: [e.g., Buy, Hold, Sell], Price Target: $XXX.XX, Date: [Date]

The rationale behind differing ratings often stems from varying interpretations of financial data, future growth prospects, and risk tolerance. For instance, a “Buy” rating might reflect an analyst’s belief in strong future growth, while a “Sell” rating could indicate concerns about profitability or competitive pressures.

TXN Stock Trading Volume and Volatility

Understanding trading volume and volatility provides insights into market sentiment and price fluctuations. High trading volume often suggests increased investor interest, while high volatility indicates greater price swings.

Current Trading Volume: The current trading volume for TXN stock is [state the volume, e.g., X million shares].

Historical Volatility: Historically, TXN stock has exhibited [describe the volatility, e.g., moderate, high, low] volatility compared to other semiconductor companies. This is influenced by factors such as [mention influencing factors, e.g., the cyclical nature of the semiconductor industry, investor sentiment, and macroeconomic conditions].

Comparison to Industry Averages: TXN’s trading volume and volatility are [describe the comparison, e.g., above, below, in line with] the industry averages for semiconductor stocks.

Relationship Between Volume and Price Fluctuations: Generally, increased trading volume is often associated with greater price fluctuations. Periods of high volume can indicate heightened investor activity, leading to more pronounced price movements, either upwards or downwards.

Key Questions Answered

What are the risks associated with investing in TXN stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., product failures, competition), and macroeconomic factors. TXN, like other semiconductor companies, is subject to these risks.

Where can I find real-time TXN stock price updates?

Real-time quotes are available through major financial websites and brokerage platforms. Many financial news sources also provide live updates.

How often is TXN stock price data updated?

TXN stock price data is typically updated in real-time during market trading hours. Historical data is usually available at the end of each trading day.

What is the typical trading volume for TXN stock?

Trading volume varies daily but can be found on financial websites providing historical and current market data.