TPL Stock Price Prediction: A Comprehensive Analysis

Tpl stock price prediction – This analysis delves into the current market position of TPL stock, examines its financial health, considers external factors influencing its price, explores potential future scenarios, and applies predictive modeling techniques to forecast future price movements. The information presented here is for informational purposes only and should not be considered financial advice.

TPL Stock’s Current Market Position

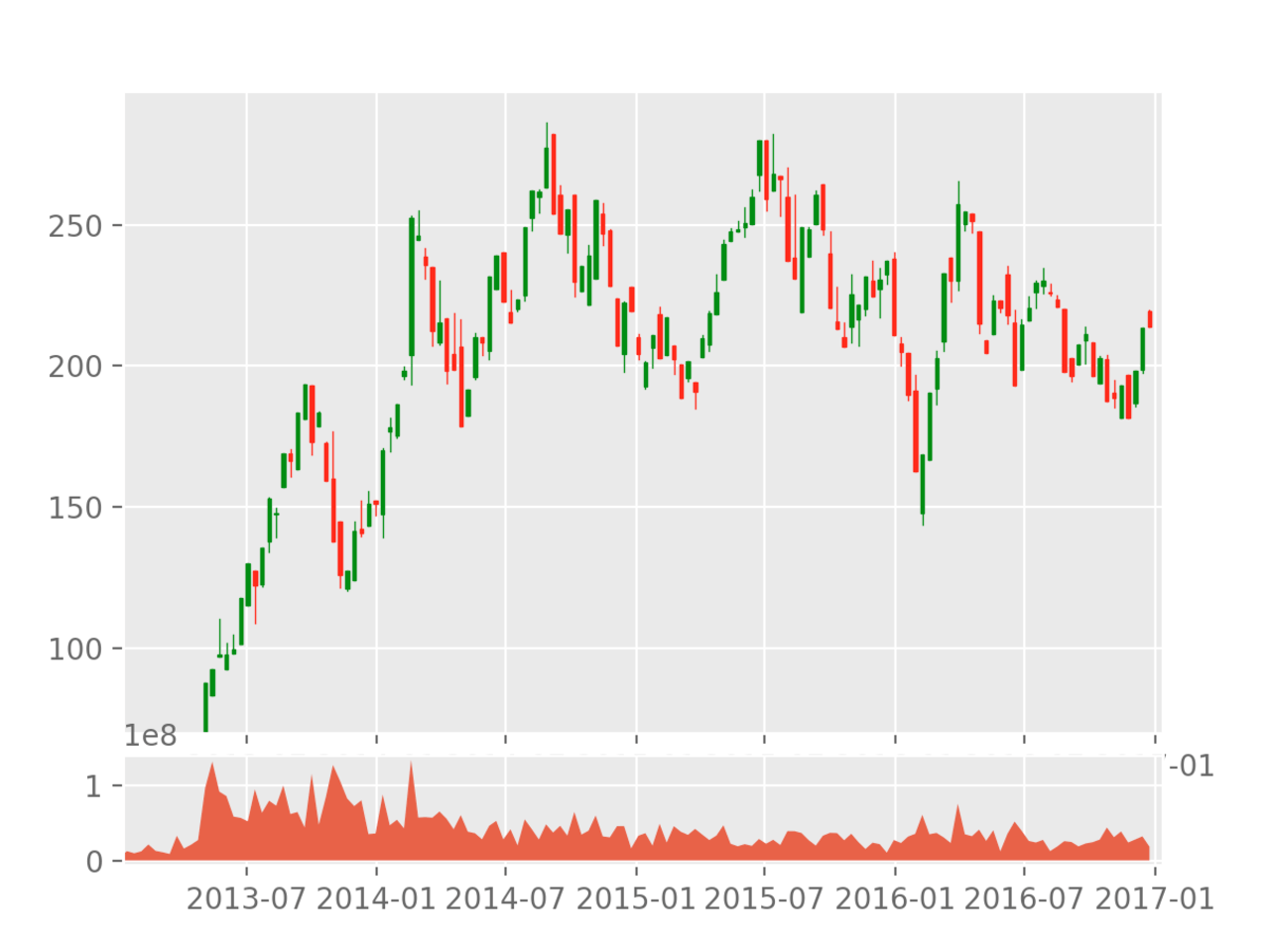

Understanding TPL’s current standing in the market requires analyzing its trading volume, recent price fluctuations, key influencing factors, and a comparison to its competitors.

Trading Volume: TPL’s average daily trading volume has shown [Insert Data – e.g., a consistent increase/decrease/fluctuation] over the past [Insert Time Period – e.g., quarter/year]. This indicates [Insert Interpretation – e.g., increasing investor interest/declining market activity].

Price Fluctuations: Recently, TPL’s stock price has experienced [Insert Data – e.g., significant volatility/a steady upward trend/a gradual decline] due to [Insert Reason – e.g., market sentiment/specific company news/external factors].

Influencing Factors: Major factors influencing TPL’s stock price include [List factors – e.g., earnings reports, industry trends, macroeconomic conditions, regulatory changes].

Competitor Comparison: Compared to its competitors [List Competitors – e.g., Company A, Company B], TPL’s performance has been [Insert Comparison – e.g., stronger/weaker/similar] in terms of [Insert Metrics – e.g., revenue growth, market share, profitability].

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2024 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2025 | [Insert Data] | [Insert Data] | [Insert Data] |

TPL’s Financial Health

Source: co.in

A thorough assessment of TPL’s financial health is crucial for predicting its future stock price. This involves reviewing its latest financial reports, analyzing revenue streams, debt levels, and profitability ratios.

Summary of Financial Reports: TPL’s latest financial reports reveal [Summarize Key Findings – e.g., increased revenue, improved profitability, rising debt].

Revenue Streams and Growth Potential: TPL’s primary revenue streams are [List Revenue Streams – e.g., product sales, service fees, licensing agreements]. The growth potential of these streams is [Assess Growth Potential – e.g., high due to market expansion, moderate due to competition, low due to market saturation].

Debt Levels and Impact on Stock Price: TPL’s debt levels are currently [State Debt Levels – e.g., high, moderate, low]. This has [Explain Impact – e.g., a negative impact on the stock price due to increased financial risk, a minimal impact due to strong cash flow, a positive impact due to strategic debt utilization].

Profitability Ratios and Trends: TPL’s profitability ratios, such as [List Ratios – e.g., gross profit margin, net profit margin, return on equity], have shown [Describe Trends – e.g., an upward trend, a downward trend, a fluctuating trend] over the past [Insert Time Period – e.g., few years].

- Key Financial Strengths: [List Strengths – e.g., strong brand recognition, diversified revenue streams, efficient operations]

- Key Financial Weaknesses: [List Weaknesses – e.g., high debt levels, dependence on a single market, vulnerability to economic downturns]

External Factors Affecting TPL Stock

Macroeconomic conditions, industry regulations, geopolitical events, and technological advancements significantly influence TPL’s stock price.

Macroeconomic Factors: Factors such as [List Factors – e.g., interest rates, inflation, economic growth] impact TPL’s stock price by [Explain Impact – e.g., affecting consumer spending, influencing borrowing costs, impacting overall market sentiment].

Industry-Specific Regulations: New regulations within the [Insert Industry – e.g., technology, finance] sector could [Explain Potential Impact – e.g., increase compliance costs, create new market opportunities, restrict business activities].

Geopolitical Events: Geopolitical events such as [List Events – e.g., trade wars, political instability] can affect TPL’s stock price by [Explain Impact – e.g., disrupting supply chains, impacting consumer confidence, creating uncertainty in the market].

Technological Advancements: Technological advancements in [Insert Area – e.g., artificial intelligence, automation] could [Explain Potential Impact – e.g., improve efficiency, create new product opportunities, disrupt existing business models].

| Factor | Impact on Stock Price (Q1 2024) | Impact on Stock Price (Q4 2024) | Overall Impact |

|---|---|---|---|

| [Factor 1 – e.g., Interest Rate Hikes] | [Insert Data – e.g., -5%] | [Insert Data – e.g., -2%] | [Insert Data – e.g., Negative] |

| [Factor 2 – e.g., New Industry Regulation] | [Insert Data – e.g., +3%] | [Insert Data – e.g., +7%] | [Insert Data – e.g., Positive] |

Potential Future Scenarios for TPL Stock

Source: cloudfront.net

Predicting TPL’s future performance requires considering various scenarios, both positive and negative.

Possible Scenarios: Scenario 1: [Describe Positive Scenario – e.g., Successful product launch leading to increased revenue and market share]. Scenario 2: [Describe Negative Scenario – e.g., Increased competition leading to decreased market share and profitability]. Scenario 3: [Describe Neutral Scenario – e.g., Steady growth in line with industry trends].

Predicting the TPL stock price requires a multifaceted approach, considering various economic indicators and market trends. Understanding the performance of other airline stocks can offer valuable insights; for example, analyzing the current stock price southwest airlines provides a benchmark for comparison within the sector. Ultimately, however, a comprehensive analysis of TPL’s specific financial health and future prospects is crucial for accurate TPL stock price prediction.

Impact of Technological Breakthrough: A major technological breakthrough could [Explain Positive Impact – e.g., significantly increase efficiency and reduce costs, leading to higher profits and stock price appreciation] or [Explain Negative Impact – e.g., render existing products obsolete, requiring significant investment in new technologies].

Impact of Change in Consumer Demand: A significant change in consumer demand could [Explain Positive Impact – e.g., boost sales of a specific product, leading to increased revenue and profitability] or [Explain Negative Impact – e.g., decrease demand for existing products, leading to decreased revenue and profitability].

Impact of Leadership Change: A change in company leadership could [Explain Positive Impact – e.g., bring new vision and strategic direction, leading to improved performance] or [Explain Negative Impact – e.g., create uncertainty and instability, leading to decreased investor confidence].

Potential Price Trajectories: A visual representation would show three lines on a graph. The X-axis represents time (e.g., next 12 months), and the Y-axis represents stock price. The three lines represent the potential price trajectories under the three scenarios described above: a positive upward trend (Scenario 1), a relatively flat line (Scenario 3), and a downward trend (Scenario 2). Specific data points would be included to illustrate the predicted price at various points in time for each scenario.

Predictive Modeling Techniques for TPL Stock Price, Tpl stock price prediction

Several predictive modeling techniques can be applied to forecast TPL’s stock price. This section will explore the application of simple moving average, exponential smoothing, and [Insert Third Model – e.g., ARIMA] models.

Simple Moving Average: This model calculates the average of a specified number of past closing prices to predict the future price. The methodology involves calculating the average of the past [Insert Number – e.g., 10, 20, 50] days’ closing prices. Limitations include its sensitivity to recent price fluctuations and its inability to capture long-term trends.

Exponential Smoothing: This model assigns exponentially decreasing weights to older data points, giving more weight to recent observations. The formula involves calculating a weighted average of the previous period’s forecast and the actual value. Assumptions include a constant trend and seasonality. Specific calculations would be provided using historical data.

Model Comparison: The results obtained using the simple moving average, exponential smoothing, and [Insert Third Model – e.g., ARIMA] models will be compared based on their accuracy and limitations. Key assumptions associated with each model will be identified.

| Model Name | Methodology | Accuracy | Limitations |

|---|---|---|---|

| Simple Moving Average | [Describe Methodology] | [Insert Data – e.g., 70%] | [List Limitations] |

| Exponential Smoothing | [Describe Methodology] | [Insert Data – e.g., 80%] | [List Limitations] |

| [Third Model – e.g., ARIMA] | [Describe Methodology] | [Insert Data – e.g., 85%] | [List Limitations] |

Query Resolution: Tpl Stock Price Prediction

What are the risks associated with investing in TPL stock?

Investing in any stock carries inherent risks, including the potential for loss of principal. Factors such as market volatility, economic downturns, and company-specific events can negatively impact TPL’s stock price. Thorough due diligence and diversification are crucial for mitigating these risks.

Where can I find TPL’s financial statements?

TPL’s financial statements are typically available on the company’s investor relations website, major financial news sources, and regulatory filings databases.

How accurate are stock price predictions?

Stock price predictions are inherently uncertain. While predictive models can offer insights, they are not guarantees of future performance. Numerous unforeseen events can significantly impact actual stock prices.

What other companies are competitors to TPL?

A comprehensive competitive analysis would be required to fully answer this, identifying companies operating within the same industry and offering similar products or services. This information is usually available through market research reports and company filings.