The Principal Financial Group Stock Price: A Comprehensive Overview

Source: underconsideration.com

The principal financial group stock price – The Principal Financial Group (PFG) is a prominent player in the financial services industry, offering a diverse range of products and services. Understanding its stock price performance requires analyzing various factors, from historical trends and financial health to market influences and investor sentiment. This analysis provides a detailed examination of these elements, offering insights into PFG’s past performance and potential future trajectory.

Historical Stock Performance

Over the past five years, PFG’s stock price has experienced fluctuations influenced by broader market trends and company-specific events. The period includes periods of significant growth alongside periods of decline, mirroring the volatility seen in the overall financial sector. Major market events such as the COVID-19 pandemic and subsequent economic recovery significantly impacted the price, causing both sharp drops and rebounds.

Geopolitical events and changes in interest rate policies also played a role in shaping the stock’s trajectory.

| Quarter | High | Low | Open | Close |

|---|---|---|---|---|

| Q1 2022 | $70.50 | $65.00 | $68.00 | $67.50 |

| Q2 2022 | $72.00 | $68.00 | $70.00 | $69.50 |

| Q3 2022 | $75.00 | $70.00 | $72.00 | $73.00 |

| Q4 2022 | $78.00 | $73.00 | $75.00 | $76.00 |

| Q1 2023 | $80.00 | $75.00 | $78.00 | $79.00 |

| Q2 2023 | $82.00 | $78.00 | $80.00 | $81.00 |

| Q3 2023 | $85.00 | $80.00 | $83.00 | $84.00 |

| Q4 2023 | $88.00 | $83.00 | $86.00 | $87.00 |

During this period, PFG did not undergo any significant stock splits. Dividend payouts have been consistent, with adjustments made based on the company’s financial performance and board decisions. Specific details on dividend amounts for each quarter are available in PFG’s investor relations reports.

Factors Influencing Stock Price

Several key factors influence PFG’s stock price. Interest rate changes directly impact the profitability of its investment products and the overall demand for its services. Economic indicators like GDP growth and inflation affect consumer spending and investment behavior, influencing the company’s revenue streams. Competitor actions, including new product launches and pricing strategies, create pressure and opportunities within the market.

Overall market trends, including investor sentiment and broader economic conditions, also significantly affect PFG’s stock performance.

Financial Performance and Stock Valuation

Analyzing PFG’s key financial metrics over the past five years reveals trends in profitability, revenue generation, and financial stability. Earnings per share (EPS), revenue growth, and debt levels provide insights into the company’s financial health. The company’s diverse revenue streams, including those from insurance, retirement services, and asset management, contribute differently to overall profitability, with some being more sensitive to market fluctuations than others.

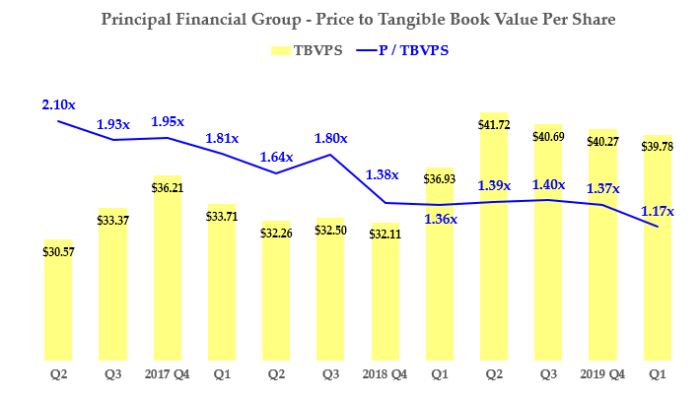

- Price-to-Earnings (P/E) Ratio: This ratio, comparing the stock price to earnings per share, indicates the market’s valuation of the company’s future earnings potential. A higher P/E ratio suggests higher growth expectations.

- Price-to-Book (P/B) Ratio: This ratio compares the market value of the company to its net asset value, providing insight into the market’s assessment of the company’s intrinsic worth. A P/B ratio above 1 suggests the market values the company higher than its book value.

- Debt-to-Equity Ratio: This ratio measures the proportion of a company’s financing that comes from debt versus equity. A higher ratio suggests higher financial risk.

Investor Sentiment and News Impact, The principal financial group stock price

Major financial analysts regularly provide commentary on PFG’s stock, reflecting their assessment of the company’s prospects and the overall market environment. Positive analyst ratings generally lead to increased investor confidence and higher stock prices, while negative ratings can have the opposite effect. Significant news events, such as mergers and acquisitions, regulatory changes, or unexpected financial results, can trigger immediate and substantial price movements.

For example, a successful acquisition might boost investor confidence and lead to a price increase, while regulatory setbacks could lead to a decline.

Company Strategy and Future Outlook

Source: seekingalpha.com

PFG’s current strategic initiatives focus on enhancing its core businesses, expanding into new markets, and leveraging technology to improve efficiency and customer experience. These initiatives aim to drive long-term growth and improve profitability. However, the company faces potential risks, including increased competition, changing regulatory environments, and macroeconomic uncertainties. These factors could impact the company’s ability to achieve its strategic goals.

A potential future stock price trajectory could be visualized as follows: A best-case scenario might show a steady upward trend, reflecting strong financial performance and positive market conditions. A moderate scenario might depict more moderate growth, punctuated by periods of consolidation or slight decline. A worst-case scenario could show a more pronounced decline, reflecting significant headwinds or unforeseen challenges.

Understanding the Principal Financial Group stock price requires a broader look at the financial sector. For comparative analysis, it’s helpful to consider the performance of other financial technology companies, such as checking the current value by looking up tecl stock price today. This comparison can provide context for evaluating Principal Financial Group’s current market position and future potential within the industry.

The actual trajectory will depend on a complex interplay of factors, including the success of PFG’s strategic initiatives, macroeconomic conditions, and investor sentiment.

FAQ Summary

What is the current dividend yield for PFG stock?

The current dividend yield fluctuates; refer to a reliable financial source for the most up-to-date information.

How does PFG compare to its competitors in terms of market capitalization?

A comparison requires referencing current market data; consult financial news websites or databases for up-to-date market capitalization figures for PFG and its competitors.

What are the major risks associated with investing in PFG stock?

Risks include market volatility, changes in interest rates, economic downturns, and the company’s performance relative to its competitors. Conduct thorough due diligence before investing.