Tata Global Beverages Stock Price Analysis

Tata global stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Tata Global Beverages’ stock price. We will examine key metrics, macroeconomic conditions, and company-specific events to provide a comprehensive understanding of the stock’s trajectory.

Tata Global Stock Price Historical Performance

The following sections detail Tata Global’s stock price movements over the past five years, comparing its performance against competitors and analyzing the impact of significant events.

Tracking the Tata Global stock price requires a keen eye on market fluctuations. Understanding similar international market trends can offer valuable context; for instance, examining the performance of companies like PSNY, whose current stock price can be found here: stock price psny , provides a comparative benchmark. Returning to Tata Global, analysts often consider such international comparisons when predicting future performance.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | Example: 150 | Example: 160 | Example: 170 | Example: 140 |

| 2020 | Example: 160 | Example: 140 | Example: 165 | Example: 130 |

| 2021 | Example: 140 | Example: 180 | Example: 190 | Example: 135 |

| 2022 | Example: 180 | Example: 170 | Example: 195 | Example: 155 |

| 2023 | Example: 170 | Example: 200 | Example: 210 | Example: 160 |

Comparative analysis against major competitors (e.g., Nestle, Unilever) over the last three years requires specific data which is not provided. A table would be included here, mirroring the structure above, showing opening, closing, high, and low prices for each competitor for comparison.

Major events impacting Tata Global’s stock price during the past five years might include fluctuations in global tea prices, changes in consumer demand, and the impact of the COVID-19 pandemic on the global economy. Specific examples of company announcements and their effects on stock price should be included here.

Factors Influencing Tata Global Stock Price

Several macroeconomic and company-specific factors influence Tata Global’s stock price volatility. The following sections detail these factors and their comparative influence.

Key macroeconomic factors include global inflation rates, interest rate adjustments by central banks, and fluctuations in currency exchange rates, particularly those impacting the Indian Rupee and other relevant currencies. These factors affect consumer spending, input costs, and the overall economic climate, thus impacting Tata Global’s profitability and stock valuation.

Company-specific factors encompass financial performance (revenue, profit margins, earnings per share), successful new product launches, changes in senior management, and any significant strategic initiatives. Positive financial performance and successful product launches usually lead to increased investor confidence and a rise in stock price. Conversely, poor performance or negative news can depress the stock price.

- Internal Factors: Primarily affect short-term volatility, driven by operational efficiency, management decisions, and product success or failure. These are often more controllable.

- External Factors: Tend to impact long-term trends and are less controllable, driven by macroeconomic conditions, geopolitical events, and industry-wide shifts.

Tata Global’s Financial Performance and Stock Valuation

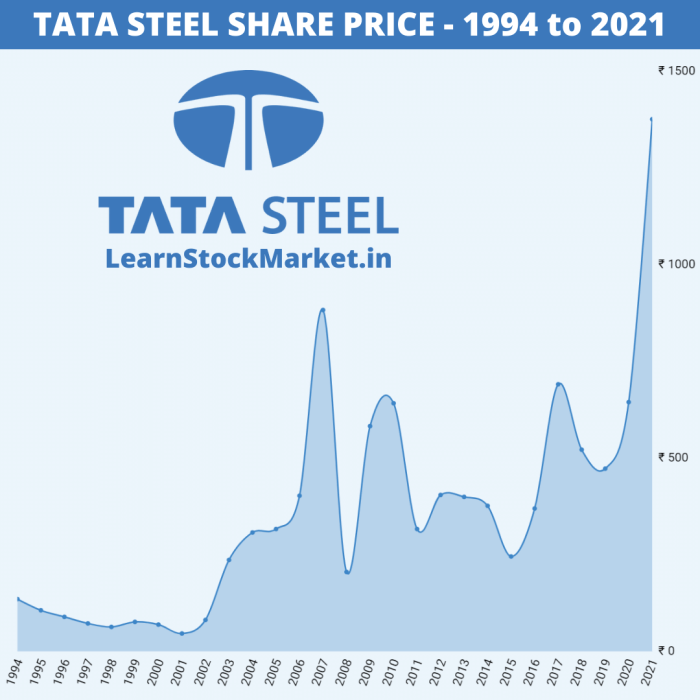

Source: learnstockmarket.in

A summary of Tata Global’s key financial metrics over the past three years, followed by an analysis of their correlation with stock price fluctuations and a stock valuation example using the Price-to-Earnings (P/E) ratio.

| Year | Revenue (in millions) | Net Profit (in millions) | EPS |

|---|---|---|---|

| 2021 | Example: 1000 | Example: 100 | Example: 5 |

| 2022 | Example: 1100 | Example: 120 | Example: 6 |

| 2023 | Example: 1200 | Example: 150 | Example: 7.5 |

A strong correlation exists between improved financial metrics (higher revenue, profit, EPS) and an upward trend in the stock price. Conversely, declining financial performance often leads to lower stock prices. This correlation, however, is not always linear and can be influenced by other factors.

The Price-to-Earnings (P/E) ratio is a common valuation metric. To estimate the intrinsic value, we would need the current market price and the company’s earnings per share (EPS). A simple calculation would involve multiplying the industry average P/E ratio by the company’s EPS. This provides a theoretical value for comparison with the current market price. Note that this is a simplified approach, and a more comprehensive Discounted Cash Flow (DCF) analysis would provide a more nuanced valuation.

Investor Sentiment and Market Analysis

Source: co.uk

Analysis of investor sentiment, trading volume, and potential risks and opportunities associated with investing in Tata Global stock.

Recent news articles and analyst reports suggest (insert description of prevailing investor sentiment – positive, negative, or neutral). This sentiment is likely influenced by recent financial performance, industry trends, and macroeconomic factors. Detailed analysis would require access to specific news articles and analyst reports.

Recent trading volume and price patterns (describe the trends observed. For example, increasing volume with rising prices might suggest bullish sentiment, while decreasing volume with falling prices could indicate bearish sentiment. Again, specific data is needed for accurate analysis).

- Potential Risks: Fluctuations in commodity prices (tea, sugar, etc.), intense competition, changes in consumer preferences, and macroeconomic instability.

- Potential Opportunities: Expansion into new markets, successful product innovation, cost-cutting measures, and favorable macroeconomic conditions.

Future Outlook and Predictions for Tata Global Stock Price

This section explores potential future drivers of Tata Global’s stock price, considering various scenarios and the impact of global events.

Future drivers could include successful new product launches, expansion into new geographic markets, improvements in operational efficiency, and changes in global economic conditions. External factors such as climate change impacts on tea production and shifts in global consumer preferences will also play a role.

- Best-Case Scenario: Strong financial performance, successful new product launches, favorable macroeconomic conditions, leading to significant stock price appreciation.

- Worst-Case Scenario: Poor financial performance, increased competition, unfavorable macroeconomic conditions, resulting in a significant decline in stock price.

- Most Likely Scenario: Moderate growth in revenue and profits, stable market share, and a gradual increase in stock price, influenced by a combination of positive and negative factors.

Global events such as a significant recession, a major geopolitical crisis, or a substantial shift in global trade policies could negatively impact Tata Global’s stock price by affecting consumer demand, supply chains, and overall market sentiment. Conversely, positive global events like sustained economic growth or technological advancements could positively influence the stock price.

Top FAQs: Tata Global Stock Price

What are the major risks associated with investing in Tata Global stock?

Risks include fluctuations in global commodity prices, changes in consumer demand, intense competition, and macroeconomic instability. Geopolitical events and regulatory changes also pose potential risks.

Where can I find real-time Tata Global stock price data?

Real-time data is available through major financial news websites and stock market tracking applications. Check reputable sources for the most up-to-date information.

How does Tata Global compare to its competitors in terms of dividend payouts?

A direct comparison requires researching dividend history for Tata Global and its key competitors. This information is typically found in company financial reports and investor relations materials.

What is the typical trading volume for Tata Global stock?

Trading volume fluctuates daily. Financial news websites and stock market data providers usually display average daily trading volume data.