Understanding Stock Price Targets

Stocks price target – Stock price targets, essentially predictions of a stock’s future price, are a crucial element in investment analysis. Understanding their methodologies, limitations, and interpretation is vital for informed decision-making. This section delves into the various aspects of stock price targets, providing a comprehensive overview for investors of all levels.

Stock Price Target Methodologies

Several methodologies exist for determining stock price targets. These approaches vary in complexity and underlying assumptions. Common methods include discounted cash flow (DCF) analysis, relative valuation, and precedent transactions.

- Discounted Cash Flow (DCF) Analysis: This intrinsic valuation method projects a company’s future cash flows and discounts them back to their present value using a discount rate that reflects the risk associated with the investment. The present value represents the estimated intrinsic value of the company, serving as a potential price target.

- Relative Valuation: This method compares a company’s valuation multiples (such as Price-to-Earnings ratio or Price-to-Sales ratio) to those of its peers or industry averages. By adjusting for differences in growth rates and risk profiles, analysts can derive a target price based on relative valuation.

- Precedent Transactions: This approach analyzes past transactions involving comparable companies to estimate the potential price of the target company. This method is often used in mergers and acquisitions.

Factors Influencing Stock Price Target Accuracy

The accuracy of stock price targets is influenced by several factors, including the quality of the underlying assumptions, the predictability of the company’s future performance, and the overall market conditions.

- Accuracy of Financial Projections: Inherent uncertainty exists in projecting future cash flows and earnings. Inaccurate projections directly impact the accuracy of DCF models.

- Market Sentiment and External Factors: Macroeconomic conditions, industry trends, and investor sentiment can significantly affect a stock’s price, regardless of the company’s fundamentals.

- Unforeseen Events: Unexpected events, such as natural disasters, regulatory changes, or significant competitive shifts, can drastically alter a company’s prospects and invalidate initial price targets.

Comparison of Price Target Models

Different price target models have their own strengths and weaknesses. A comparative analysis helps in understanding their applicability in various scenarios.

| Model | Advantages | Disadvantages |

|---|---|---|

| Discounted Cash Flow (DCF) | Intrinsic value-based, less susceptible to market sentiment | Relies heavily on future projections, sensitive to discount rate assumptions |

| Relative Valuation | Relatively simple, easy to understand and compare | Relies on comparable companies, susceptible to market mispricing |

| Precedent Transactions | Provides market-based valuation, useful for M&A analysis | Limited applicability if comparable transactions are scarce |

Sources of Stock Price Targets

Source: financeshots.com

Stock price targets originate from various sources, each with its own level of credibility and potential biases. Understanding these sources is essential for evaluating the reliability of the information.

Key Sources of Stock Price Targets

Investment banks, financial analysts, and independent research firms are the primary sources of stock price targets. Each source brings a unique perspective and methodology.

- Investment Banks: Often provide price targets as part of their research coverage for companies they may be advising on mergers, acquisitions, or other transactions. Their targets may be influenced by their client relationships.

- Financial Analysts: Employed by brokerage firms or investment management companies, these analysts publish research reports that include price targets based on their own models and analysis.

- Independent Research Firms: These firms conduct independent research and provide price targets without the potential conflicts of interest associated with investment banks or brokerage firms.

Credibility and Reliability of Sources

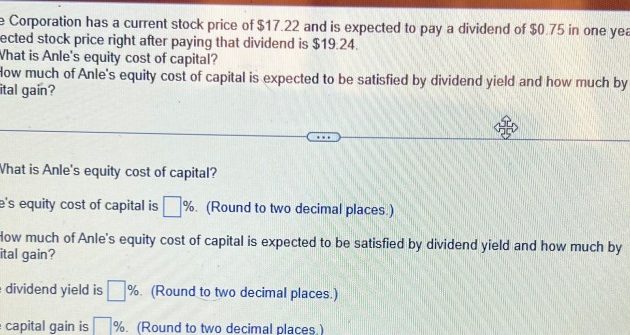

Source: cheggcdn.com

The credibility and reliability of different sources vary significantly. Independent research firms are generally considered more reliable due to their lack of inherent conflicts of interest, although no source is immune to error.

Potential Biases in Price Targets

Various biases can influence price targets. For example, investment banks might issue optimistic targets to win business from companies they cover. Analysts might be incentivized to issue targets that align with their firm’s investment strategy.

Examples of Price Target Derivation

A hypothetical example: An investment bank might use a DCF model to derive a price target, while an independent research firm might use a combination of DCF and relative valuation. The differences in methodology and assumptions can lead to varying price targets for the same stock.

Interpreting Stock Price Targets

Price targets should not be taken as definitive predictions but rather as potential outcomes based on various assumptions. Their interpretation requires careful consideration of the underlying methodology and potential biases.

Interpreting Price Targets Relative to Market Prices

A price target above the current market price suggests the stock might be undervalued, while a target below the current price suggests it might be overvalued. However, this is just one factor to consider in investment decisions.

Best Practices for Using Price Targets

Price targets should be considered alongside other fundamental and technical analysis, and within the context of a broader investment strategy. They are not a standalone decision-making tool.

Incorporating Price Targets into Investment Strategy

A diversified portfolio approach is recommended, limiting reliance on any single price target. Investors should consider their risk tolerance, time horizon, and other investment goals when making decisions.

Framework for Evaluating Price Target Usefulness

Consider the source’s reputation, the methodology used, the underlying assumptions, and the potential biases. Compare multiple price targets from different sources to gain a more holistic perspective.

Limitations of Stock Price Targets: Stocks Price Target

Stock price targets are inherently uncertain, and relying solely on them for investment decisions can be risky. Several limitations and uncertainties exist.

Inherent Limitations and Uncertainties, Stocks price target

Price targets are based on predictions of future events, which are inherently uncertain. Changes in market conditions, company performance, or unforeseen events can render price targets inaccurate.

Impact of Unforeseen Events

Unexpected events such as economic downturns, natural disasters, or geopolitical instability can significantly impact a company’s performance and invalidate existing price targets.

Risks of Sole Reliance on Price Targets

Relying solely on price targets can lead to poor investment decisions. A comprehensive investment strategy requires considering multiple factors, not just price targets.

Examples of Inaccurate Price Targets

Many examples exist where price targets proved inaccurate. For instance, during periods of high market volatility, many price targets are significantly off the mark. The 2008 financial crisis serves as a stark reminder of this.

Stock Price Target and Company Performance

The relationship between a company’s financial performance and its stock price target is complex. While strong financial performance generally leads to higher stock prices, other factors also play a crucial role.

Historical Stock Price Performance vs. Price Targets

Historical data shows that stock prices often deviate significantly from their initial price targets. Many factors influence this deviation, including market sentiment and unexpected events.

Relationship Between Company Performance and Price Target

A company’s financial performance (revenue growth, profitability, cash flow) influences its intrinsic value, which in turn affects the reasonableness of its price target. Strong financial performance generally supports higher price targets.

Examples of Companies Exceeding/Falling Short of Price Targets

| Company | Price Target | Actual Price | Reason for Deviation |

|---|---|---|---|

| Example Company A | $100 | $150 | Exceeded due to unexpected strong product demand |

| Example Company B | $50 | $30 | Fell short due to unexpected regulatory changes |

Using Financial Statements to Evaluate Price Targets

Analyzing a company’s income statement (revenue, expenses, net income), balance sheet (assets, liabilities, equity), and cash flow statement (cash inflows and outflows) helps assess the reasonableness of a price target. For example, consistently high revenue growth and strong cash flow would support a higher price target, while declining profitability might suggest a lower target.

Visualizing Stock Price Targets

Visual Representation of Stock Price and Price Targets

A line graph would effectively visualize a stock’s historical price movement alongside its various price targets over time. The x-axis would represent time (e.g., months or years), and the y-axis would represent the stock price. The stock’s actual price would be represented by a continuous line, while different price targets from various analysts could be shown as separate horizontal lines or data points, each labeled accordingly.

Different colors could be used to distinguish between the different analysts’ price targets. Key dates, such as earnings announcements or major news events, could be marked on the x-axis to highlight potential correlation between events and price changes.

Accurately predicting a stock’s price target is challenging, requiring a thorough analysis of various factors. Understanding candlestick patterns, such as those described in detail on resources like stock price pins , can significantly aid in this process. By recognizing these patterns, investors can gain valuable insights into potential support and resistance levels, ultimately refining their price target estimations.

Chart Illustrating Distribution of Price Targets

A histogram or box plot would effectively illustrate the distribution of price targets from different analysts for a specific stock. The x-axis would represent the range of price targets, and the y-axis would represent the frequency or number of analysts predicting each price range. The chart would visually display the central tendency (mean or median) and the dispersion (range or standard deviation) of the price targets, offering a clear understanding of the consensus and the level of agreement among analysts.

Key Questions Answered

What is the difference between a price target and a forecast?

A price target is a specific price point an analyst believes a stock will reach within a certain timeframe. A forecast is a broader prediction about the overall market or a company’s performance, which may or may not include a specific price target.

How often are price targets updated?

Price targets are typically updated whenever significant news affects a company or the overall market, such as earnings announcements, major acquisitions, or changes in economic outlook. The frequency varies depending on the analyst and the firm.

Are price targets always accurate?

No, price targets are not guarantees. They are based on estimations and models that are subject to inherent uncertainties and unforeseen events. Consider them as potential outcomes rather than certainties.

Should I solely rely on price targets for investment decisions?

No. Price targets should be one factor among many in your investment decision-making process. Fundamental analysis, technical analysis, and risk tolerance are all equally important.