Understanding the SOXX ETF

Stock price soxx – The Invesco Semiconductor ETF (SOXX) tracks the performance of the semiconductor industry, providing investors with diversified exposure to leading companies in this crucial sector. This section details the ETF’s composition, weighting methodology, historical performance, and comparison to other relevant ETFs.

SOXX ETF Composition and Weighting

SOXX invests in a diversified portfolio of semiconductor companies, primarily those listed on major US exchanges. The ETF’s holdings are weighted based on market capitalization, meaning larger companies represent a larger portion of the portfolio. This weighting method reflects the relative size and influence of each company within the semiconductor market.

Historical Performance of SOXX

Source: etfdb.com

SOXX’s performance has historically mirrored the cyclical nature of the semiconductor industry. Periods of strong economic growth and technological advancement have generally been accompanied by strong SOXX returns, while economic downturns or industry-specific headwinds have led to periods of underperformance. Long-term investors should expect volatility, but the potential for significant gains over time exists.

Comparison of SOXX with Other Semiconductor ETFs

Several ETFs offer exposure to the semiconductor industry. Comparing SOXX to these alternatives helps investors choose the best fit for their investment strategies. Key factors for comparison include expense ratio, assets under management (AUM), and top holdings. A lower expense ratio indicates lower costs, while higher AUM generally suggests greater liquidity and potentially lower trading costs.

| ETF | Expense Ratio | Assets Under Management (AUM) | Top 3 Holdings (Illustrative) |

|---|---|---|---|

| SOXX (Invesco Semiconductor ETF) | 0.35% (Illustrative) | $XX Billion (Illustrative) | NVIDIA, TSM, Qualcomm (Illustrative) |

| SMH (iShares Semiconductor ETF) | 0.35% (Illustrative) | $YY Billion (Illustrative) | NVIDIA, TSM, AMD (Illustrative) |

| VANECK Semiconductor ETF | 0.35% (Illustrative) | $ZZ Billion (Illustrative) | NVIDIA, TSM, Intel (Illustrative) |

| Another Semiconductor ETF | 0.40% (Illustrative) | $WW Billion (Illustrative) | NVIDIA, AMD, Texas Instruments (Illustrative) |

Factors Influencing SOXX Stock Price

The price of SOXX is influenced by a complex interplay of macroeconomic factors, geopolitical events, technological advancements, and company-specific news. Understanding these influences is crucial for effective investment decision-making.

Macroeconomic Factors Affecting SOXX

Global economic growth, interest rates, inflation, and consumer spending significantly impact the semiconductor industry’s demand. Strong economic growth usually translates to increased demand for semiconductors, boosting SOXX’s price. Conversely, economic downturns often lead to reduced demand and lower SOXX prices.

Geopolitical Events and SOXX Performance

Geopolitical instability, trade wars, and sanctions can disrupt semiconductor supply chains and affect the industry’s overall performance. Events such as the US-China trade tensions or regional conflicts can create uncertainty and volatility in SOXX’s price.

Technological Advancements and SOXX Price

Technological breakthroughs in areas such as artificial intelligence, 5G, and the Internet of Things (IoT) drive demand for advanced semiconductors. These advancements often lead to increased investment in semiconductor companies, positively impacting SOXX’s price.

Impact of Specific Company News on SOXX, Stock price soxx

Positive or negative news regarding individual semiconductor companies significantly impacts SOXX’s price. For example, strong earnings reports from major players like NVIDIA or Intel generally boost SOXX, while disappointing results or negative announcements can lead to price declines.

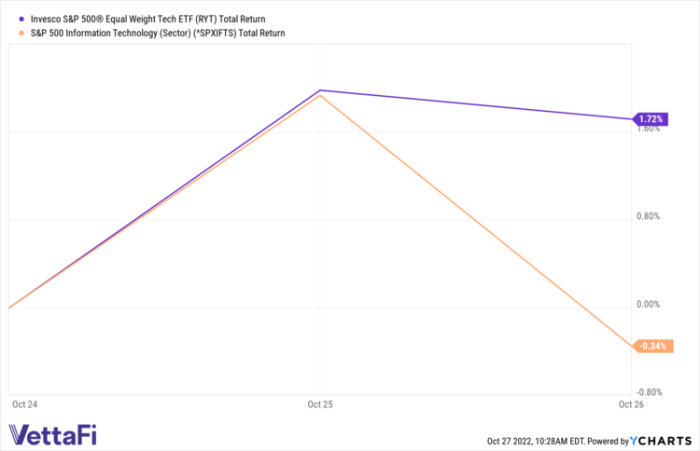

Correlation Between SOXX and NASDAQ

A chart illustrating the correlation between SOXX’s price and the NASDAQ Composite Index would likely show a strong positive correlation. Both indices are heavily influenced by the performance of technology companies. Periods of strong growth in the tech sector, reflected in the NASDAQ, would typically coincide with upward movements in SOXX, and vice versa. The chart would visually demonstrate the interconnectedness of the semiconductor industry with the broader technology market.

A high correlation coefficient (e.g., above 0.8) would visually support this strong relationship.

Analyzing SOXX Price Volatility: Stock Price Soxx

SOXX exhibits significant price volatility, reflecting the cyclical nature of the semiconductor industry and its sensitivity to macroeconomic and geopolitical factors. Understanding this volatility and implementing appropriate risk management strategies are essential for investors.

Historical Volatility of SOXX

Historically, SOXX has shown periods of both high and low volatility. Periods of high volatility are often associated with significant economic or geopolitical events, industry-specific disruptions (such as supply chain issues), or major shifts in technology adoption. Conversely, periods of relative stability are usually seen during times of consistent economic growth and predictable technological advancements.

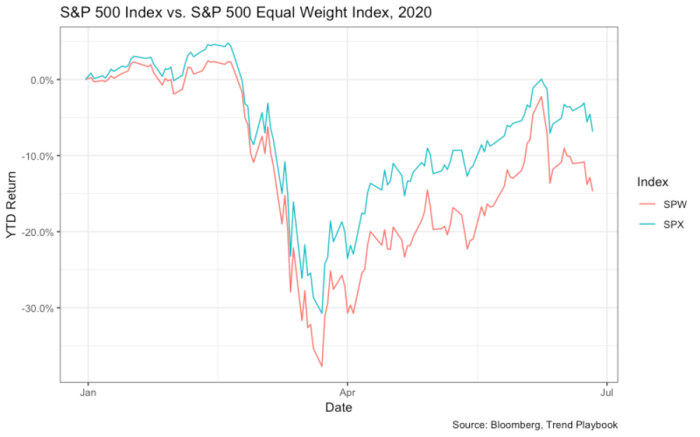

Comparison of SOXX Volatility to the Broader Market

Source: thestreet.com

Understanding the fluctuations in the SOXX index, which tracks semiconductor stocks, requires a broad perspective on the tech sector. For instance, comparing its performance against the energy sector, as exemplified by tracking the stock price of companies like PSE&G, offers valuable insights. To delve deeper into the specifics of PSE&G’s performance, you can check out this resource on the stock price pseg.

Ultimately, analyzing both SOXX and energy sector performance helps paint a more complete picture of overall market trends.

SOXX’s volatility is generally higher than that of the broader market, reflecting the industry’s sensitivity to economic cycles and technological shifts. This increased volatility presents both opportunities and risks for investors. While potential returns can be higher, so too can potential losses.

Significant Price Swings in SOXX and Contributing Factors

Several instances in SOXX’s history highlight significant price swings. For example, the COVID-19 pandemic initially caused a downturn but later spurred a surge in demand for semiconductors used in remote work and online services. Similarly, geopolitical tensions have historically led to increased uncertainty and price volatility.

Risk Management Strategies for SOXX Investors

Several strategies can help investors manage the risk associated with SOXX’s volatility. Diversification across different asset classes, employing stop-loss orders, and having a long-term investment horizon are key components of effective risk management.

- Diversification: Spread investments across various asset classes to reduce overall portfolio risk.

- Stop-loss orders: Set predetermined sell orders to limit potential losses.

- Dollar-cost averaging: Invest a fixed amount regularly regardless of price fluctuations.

- Long-term investment horizon: Reduce the impact of short-term volatility.

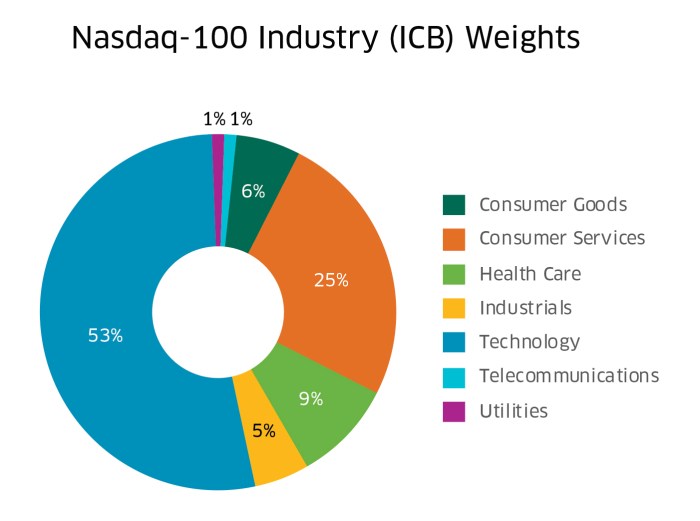

SOXX and the Semiconductor Industry

Source: nasdaq.com

SOXX’s price is intrinsically linked to the overall health and performance of the semiconductor industry. Understanding this relationship, including the impact of supply chain disruptions and major company earnings reports, is crucial for informed investment decisions.

Relationship Between SOXX Price and Semiconductor Industry Performance

SOXX’s price generally tracks the overall performance of the semiconductor industry. Strong industry performance, driven by high demand and technological innovation, usually leads to increased SOXX prices. Conversely, industry downturns often translate to lower SOXX prices.

Impact of Semiconductor Supply Chain Disruptions on SOXX

Disruptions to the semiconductor supply chain, such as those caused by natural disasters, geopolitical events, or pandemics, can significantly impact SOXX’s price. Supply shortages lead to higher prices and reduced availability of semiconductors, negatively impacting the industry’s overall performance and SOXX’s price.

Influence of Major Semiconductor Companies’ Earnings Reports on SOXX

Earnings reports from major semiconductor companies like NVIDIA, Intel, and TSMC have a significant influence on SOXX’s price. Positive earnings surprises generally lead to price increases, while negative surprises often result in price declines.

Comparison of SOXX Performance to Individual Semiconductor Companies

While SOXX provides diversified exposure to the semiconductor industry, its performance doesn’t perfectly mirror that of every individual company within the ETF. Some companies may outperform or underperform the overall ETF based on their specific business strategies, market positioning, and individual circumstances.

| Company | Weighting (%) | Company | Weighting (%) |

|---|---|---|---|

| Company A (Illustrative) | 15% (Illustrative) | Company F (Illustrative) | 5% (Illustrative) |

| Company B (Illustrative) | 12% (Illustrative) | Company G (Illustrative) | 4% (Illustrative) |

| Company C (Illustrative) | 10% (Illustrative) | Company H (Illustrative) | 3% (Illustrative) |

| Company D (Illustrative) | 8% (Illustrative) | Company I (Illustrative) | 2% (Illustrative) |

| Company E (Illustrative) | 7% (Illustrative) | Company J (Illustrative) | 2% (Illustrative) |

Future Outlook for SOXX

The future performance of SOXX depends on various factors, including technological advancements, macroeconomic conditions, and geopolitical stability. While long-term growth prospects for the semiconductor industry remain positive, investors should be aware of potential risks and challenges.

Potential Future Trends Impacting SOXX

Several trends could significantly impact SOXX’s future price. The continued growth of artificial intelligence, the expansion of 5G networks, and the increasing adoption of the Internet of Things (IoT) are expected to drive demand for advanced semiconductors. However, factors like potential supply chain disruptions, increased competition, and evolving geopolitical dynamics could also influence SOXX’s performance.

Long-Term Growth Prospects for the Semiconductor Industry

The long-term growth prospects for the semiconductor industry remain strong, driven by the increasing integration of semiconductors into various aspects of modern life. This continued growth is expected to positively impact SOXX’s long-term performance, although volatility is likely to persist.

Potential Risks and Challenges Facing the Semiconductor Sector

The semiconductor industry faces several risks and challenges, including geopolitical instability, trade wars, supply chain disruptions, and intense competition. These factors could negatively impact SOXX’s performance in the future. Furthermore, technological advancements could lead to unexpected shifts in demand, creating both opportunities and risks.

Impact of Different Macroeconomic Scenarios on SOXX

Different macroeconomic scenarios will affect SOXX differently. A strong global economic recovery would likely boost demand for semiconductors and increase SOXX’s price. Conversely, a global recession could significantly reduce demand, leading to lower SOXX prices. Inflationary pressures could increase input costs for semiconductor manufacturers, impacting profitability and potentially dampening SOXX’s growth.

Hypothetical Scenario and its Impact on SOXX

Consider a scenario where a major geopolitical event disrupts global semiconductor supply chains. This could lead to immediate price increases for semiconductors due to scarcity, potentially benefiting SOXX in the short term. However, prolonged disruptions could negatively impact overall industry growth and lead to a long-term decline in SOXX’s price, as demand might not keep pace with reduced supply.

Expert Answers

What are the potential risks associated with investing in SOXX?

Investing in SOXX carries inherent risks associated with the semiconductor industry’s cyclical nature, geopolitical uncertainties, and technological disruptions. Price volatility is also a significant consideration.

How often is the SOXX ETF rebalanced?

The SOXX ETF’s rebalancing frequency is not explicitly stated but is likely to be done periodically to maintain its target weighting and composition. Consult the official ETF documentation for precise details.

What is the minimum investment required to purchase SOXX?

The minimum investment depends on your brokerage account and the type of order (e.g., fractional shares may be available). Check with your broker for specifics.

Can I invest in SOXX through a retirement account?

Generally, yes, but the specific eligibility depends on your retirement account type (e.g., IRA, 401k) and your broker’s policies. Confirm with your broker or plan provider.