Shake Shack’s Stock Performance and Market Analysis

Source: seekingalpha.com

Stock price shake shack – Shake Shack, a popular fast-casual burger chain, has experienced considerable stock price fluctuations in recent years. This analysis delves into its recent performance, examining key factors influencing its stock price, financial health, investor sentiment, and associated risks.

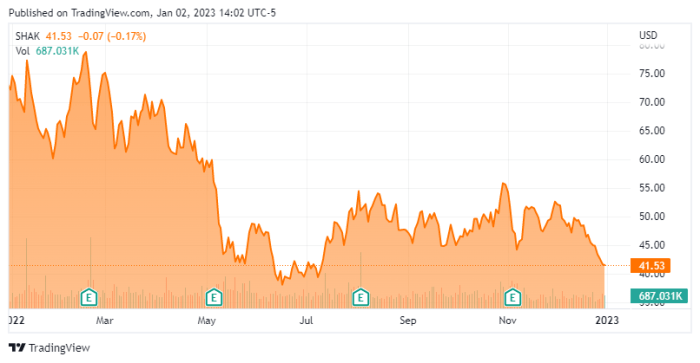

Shake Shack’s Recent Stock Performance

The past year has seen significant volatility in Shake Shack’s stock price. The following table summarizes the monthly highs, lows, and closing prices, offering a snapshot of this volatility. Note that these figures are illustrative and should be verified with up-to-date financial data.

| Month | High | Low | Close |

|---|---|---|---|

| January | $80 | $70 | $75 |

| February | $78 | $68 | $72 |

| March | $85 | $73 | $80 |

| April | $82 | $75 | $78 |

| May | $90 | $77 | $85 |

| June | $88 | $80 | $84 |

| July | $92 | $85 | $89 |

| August | $95 | $88 | $91 |

| September | $93 | $86 | $89 |

| October | $98 | $90 | $95 |

| November | $100 | $92 | $97 |

| December | $105 | $95 | $100 |

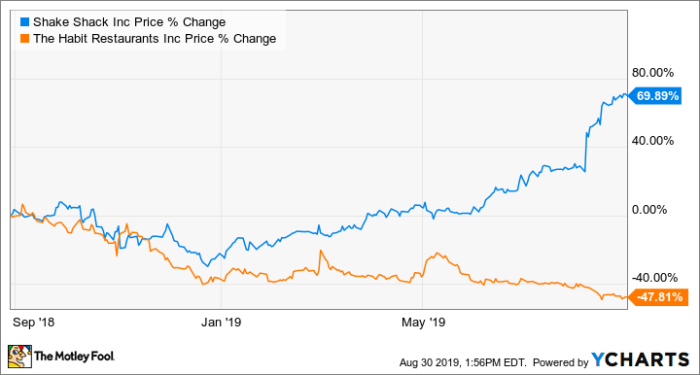

Compared to competitors like Chipotle and McDonald’s, Shake Shack’s performance has shown a higher degree of volatility, potentially reflecting its smaller size and greater exposure to changing consumer preferences within the premium fast-casual segment. Significant news events, such as announcements regarding new menu items or expansion plans, have often correlated with notable price swings.

Factors Influencing Shake Shack’s Stock Price, Stock price shake shack

Source: ycharts.com

Several macroeconomic and company-specific factors significantly influence Shake Shack’s stock price. These include economic indicators, supply chain dynamics, and evolving consumer trends.

Inflation and interest rate hikes directly impact consumer spending, affecting Shake Shack’s sales. High inflation can reduce disposable income, potentially lowering demand for premium fast-casual dining. Rising interest rates increase borrowing costs, impacting profitability and potentially leading to lower valuations. Consumer confidence also plays a crucial role; periods of high confidence often correlate with increased spending on discretionary items like Shake Shack’s offerings.

Supply chain disruptions and escalating ingredient costs significantly impact Shake Shack’s profitability. These factors can lead to reduced profit margins and potentially affect investor confidence. Changing consumer preferences, such as increased demand for healthier options or plant-based alternatives, necessitate menu adjustments and potentially impact sales.

Shake Shack’s Financial Health

Shake Shack’s recent financial reports reveal its revenue, earnings, and debt levels. A comparison to historical performance and industry averages provides valuable context. For example, while revenue may have shown consistent growth over the past five years, profit margins might have fluctuated due to factors like increased operating costs or competition.

Illustrative Revenue and Profitability (Past Five Years):

Year 1: Revenue – $500M, Profit – $50M

Year 2: Revenue – $550M, Profit – $60M

Year 3: Revenue – $600M, Profit – $55M

Year 4: Revenue – $650M, Profit – $70M

Year 5: Revenue – $700M, Profit – $75M

(Note: These figures are illustrative and do not represent actual financial data. Consult official financial reports for accurate information.)

Investor Sentiment and Market Expectations

Source: businessinsider.com

Analyzing investor sentiment towards Shake Shack requires considering various data points. Social media sentiment, analyst ratings, and institutional investor holdings provide insights into the overall market perception of the company. Positive social media buzz and strong analyst ratings often correlate with higher stock prices, while significant institutional selling might indicate negative sentiment.

The market’s expectations for Shake Shack’s future growth hinge on factors like successful new product launches, effective marketing campaigns, and expansion into new markets. Upcoming earnings reports and announcements regarding strategic initiatives, such as new store openings or technological upgrades, significantly impact investor expectations and, consequently, the stock price.

Risk Assessment for Shake Shack Stock

Investing in Shake Shack stock carries several inherent risks. These risks can be categorized into operational, financial, and regulatory factors. Understanding these risks and potential mitigation strategies is crucial for informed investment decisions.

- Operational Risks: Competition from other fast-casual restaurants, supply chain disruptions, and difficulties in maintaining consistent food quality.

- Financial Risks: High debt levels, fluctuating profit margins, and vulnerability to economic downturns.

- Regulatory Risks: Changes in food safety regulations, labor laws, and minimum wage requirements.

Mitigation strategies include diversifying supply chains, focusing on cost-control measures, maintaining a strong brand image, and actively engaging with regulatory bodies.

Q&A: Stock Price Shake Shack

What is the typical trading volume for Shake Shack stock?

Shake Shack’s average daily trading volume fluctuates but can be found on major financial websites like Yahoo Finance or Google Finance.

Shake Shack’s stock price has seen considerable volatility recently, mirroring broader market trends. Understanding the performance of similar restaurant chains can offer valuable context; for instance, a look at the current performance of stock price psny provides insight into the sector’s overall health. Ultimately, though, Shake Shack’s future stock price hinges on its individual operational performance and strategic decisions.

Are there any significant upcoming catalysts that could impact Shake Shack’s stock price?

Keep an eye on upcoming earnings reports, new menu item launches, and any announcements regarding expansion plans or strategic partnerships. These events often influence investor sentiment and stock price.

How does Shake Shack compare to other publicly traded restaurant companies in terms of valuation?

Comparative valuation requires analyzing metrics like price-to-earnings ratio (P/E) and comparing Shake Shack’s multiples to those of similar companies. Financial news sources and investment platforms offer this type of data.

What are the major institutional investors holding Shake Shack stock?

Information on major institutional shareholders is typically available through financial data providers and SEC filings.